Question: help me with 2 a part. 1) a) When there is a disposition of depreciable property, there may be recapture, a terminal loss or no

help me with 2 a part.

help me with 2 a part.

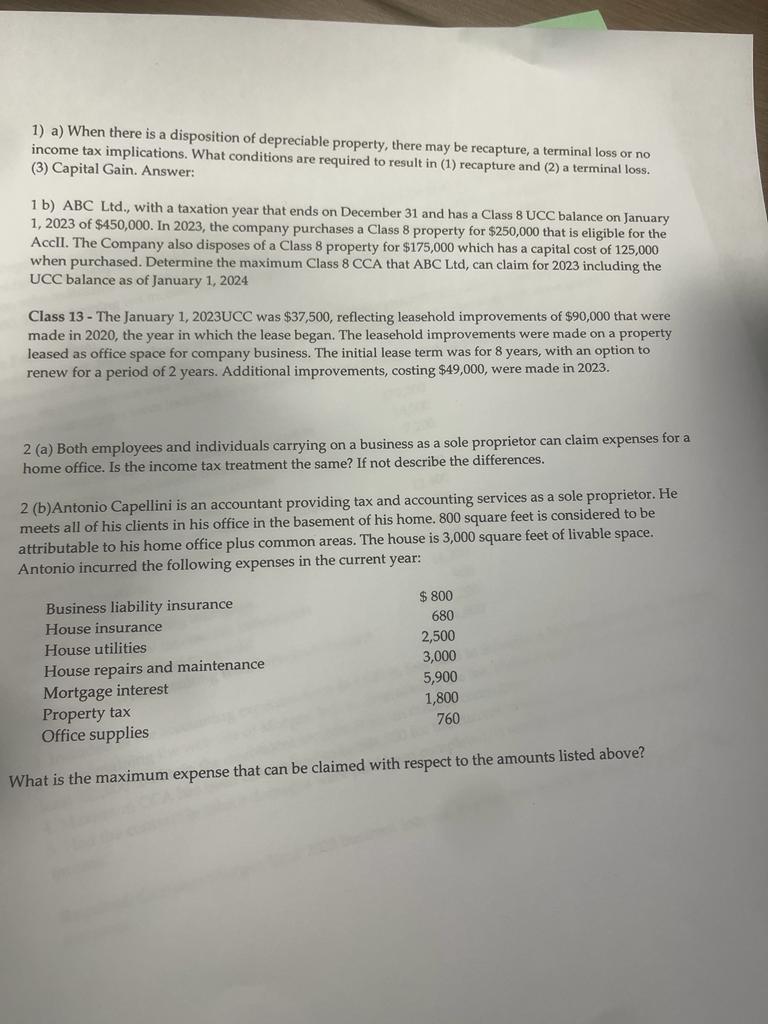

1) a) When there is a disposition of depreciable property, there may be recapture, a terminal loss or no income tax implications. What conditions are required to result in (1) recapture and (2) a terminal loss. (3) Capital Gain. Answer: 1b)ABC Ltd., with a taxation year that ends on December 31 and has a Class 8 UCC balance on January 1,2023 of $450,000. In 2023 , the company purchases a Class 8 property for $250,000 that is eligible for the AccII. The Company also disposes of a Class 8 property for $175,000 which has a capital cost of 125,000 when purchased. Determine the maximum Class 8 CCA that ABC Ltd, can claim for 2023 including the UCC balance as of January 1,2024 Class 13 - The January 1, 2023UCC was $37,500, reflecting leasehold improvements of $90,000 that were made in 2020, the year in which the lease began. The leasehold improvements were made on a property leased as office space for company business. The initial lease term was for 8 years, with an option to renew for a period of 2 years. Additional improvements, costing $49,000, were made in 2023 . 2 (a) Both employees and individuals carrying on a business as a sole proprietor can claim expenses for a home office. Is the income tax treatment the same? If not describe the differences. 2 (b)Antonio Capellini is an accountant providing tax and accounting services as a sole proprietor. He meets all of his clients in his office in the basement of his home. 800 square feet is considered to be attributable to his home office plus common areas. The house is 3,000 square feet of livable space. Antonio incurred the following expenses in the current year: What is the maximum expense that can be claimed with respect to the amounts listed above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts