Question: How do I solve this? Also please make sure that answers are rounded to three digits after the decimal. (e) Compute the fitted values and

How do I solve this? Also please make sure that answers are rounded to three digits after the decimal.

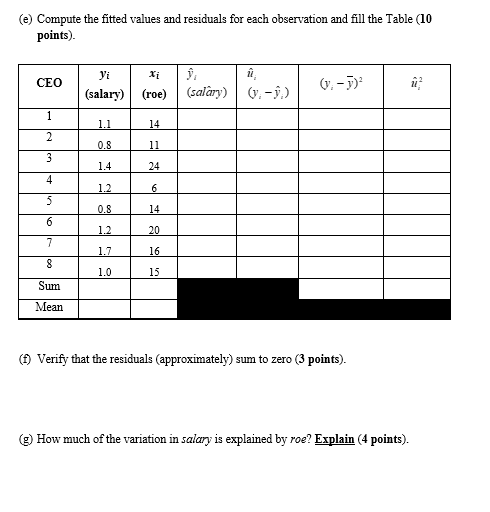

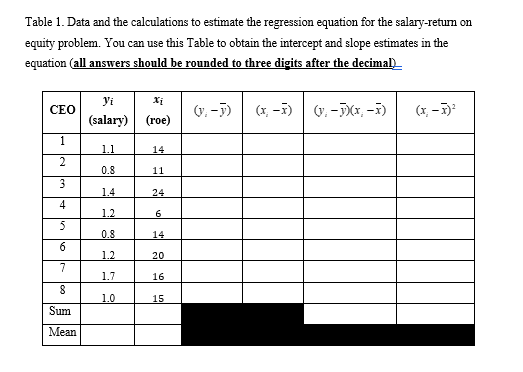

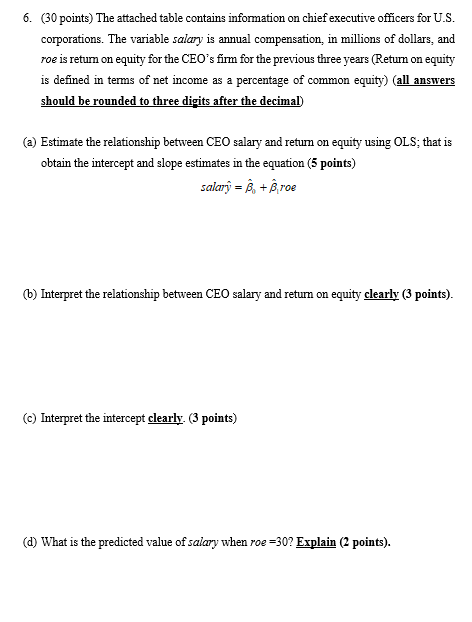

(e) Compute the fitted values and residuals for each observation and fill the Table (10 points). CEO Vi (salary) (roe) (salary) 1.1 14 0.8 11 1.4 24 1.2 6 0.8 14 1.2 20 1.7 16 1.0 15 Sum Mean (f) Verify that the residuals (approximately) sum to zero (3 points). (g) How much of the variation in salary is explained by roe? Explain (4 points).Table 1. Data and the calculations to estimate the regression equation for the salary-return on equity problem. You can use this Table to obtain the intercept and slope estimates in the equation (all answers should be rounded to three digits after the decimal) CEO Vi Xi (salary) (roe) (x, - x) () - V)(x, -x) (x - x)' 1.1 14 0.8 11 1.4 24 4 1.2 6 5 0.8 14 6 1.2 20 7 1.7 16 8 1.0 15 Sum Mean6. (30 points) The attached table contains information on chief executive officers for U.S. corporations. The variable salary is annual compensation, in millions of dollars, and roe is return on equity for the CEO's firm for the previous three years (Return on equity is defined in terms of net income as a percentage of common equity) (all answers should be rounded to three digits after the decimal) (a) Estimate the relationship between CEO salary and return on equity using OLS; that is obtain the intercept and slope estimates in the equation (5 points) salary = 6, + Broe (b) Interpret the relationship between CEO salary and return on equity clearly (3 points). (c) Interpret the intercept clearly. (3 points) (d) What is the predicted value of salary when roe =30? Explain (2 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts