Question: In Figure, why does the line decline steeply at first and then flatten out? The standard deviation Portfolio Standard Deviation of a portfolio tends to

In Figure, why does the line decline steeply at first and then flatten out?

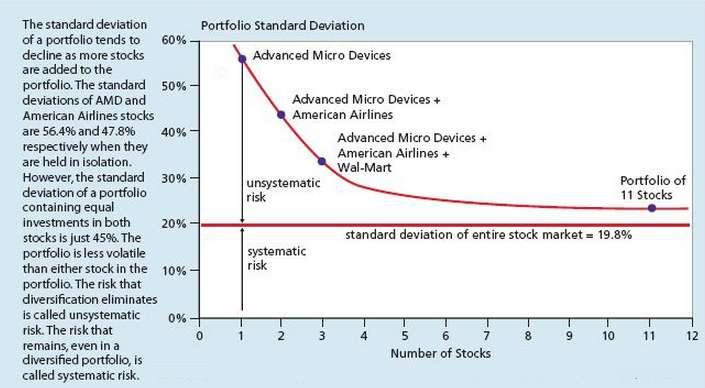

The standard deviation Portfolio Standard Deviation of a portfolio tends to decline as more stocks are added to the portfolio. The standard 50% deviations of AMD and American Airlines stocks 60% Advanced Micro Devices Advanced Micro Devices + American Airlines are 56.4% and 47.8% respectively when they are held in isolation. However, the standard 30% deviation of a portfolio containing equal investments in both 40% Advanced Micro Devices + American Airlines + Wal-Mart unsystematic risk Portfolio of 11 Stocks 20% standard deviation of entire stock market = 19.8% stocks is just 45%. The portfolio is less volatile than either stock in the 10% portfolio. The risk that diversification eliminates is called unsystematic risk. The risk that systematic risk 0% 1. 4 6. Number of Stocks 5 9. 10 11 12 remains, even in a diversified portfolio, is called systematic risk.

Step by Step Solution

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Question In Figure why does the line decline steeply at first and then flatten out The standard devi... View full answer

Get step-by-step solutions from verified subject matter experts