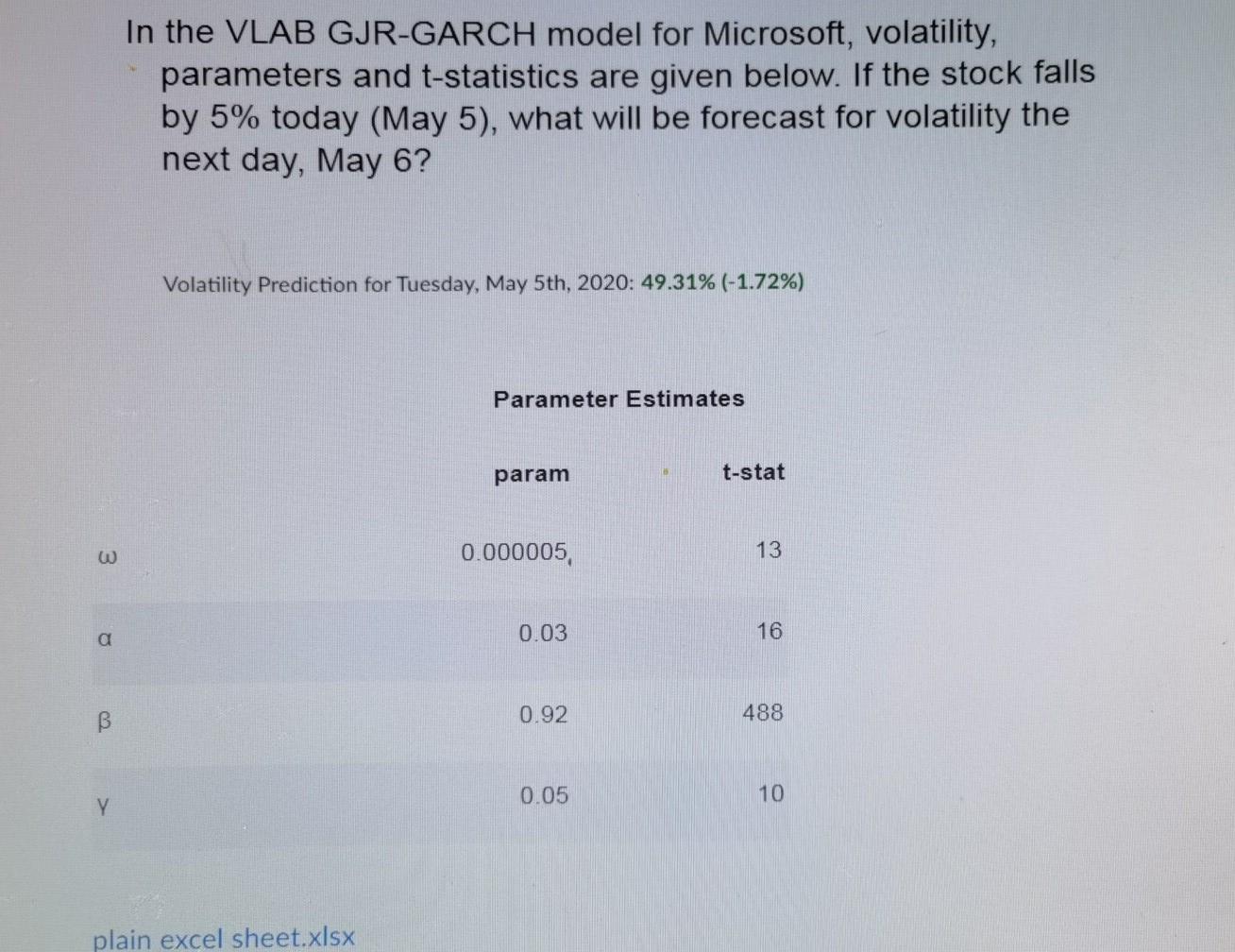

Question: In the VLAB GJR-GARCH model for Microsoft, volatility, parameters and t-statistics are given below. If the stock falls by 5% today (May 5), what will

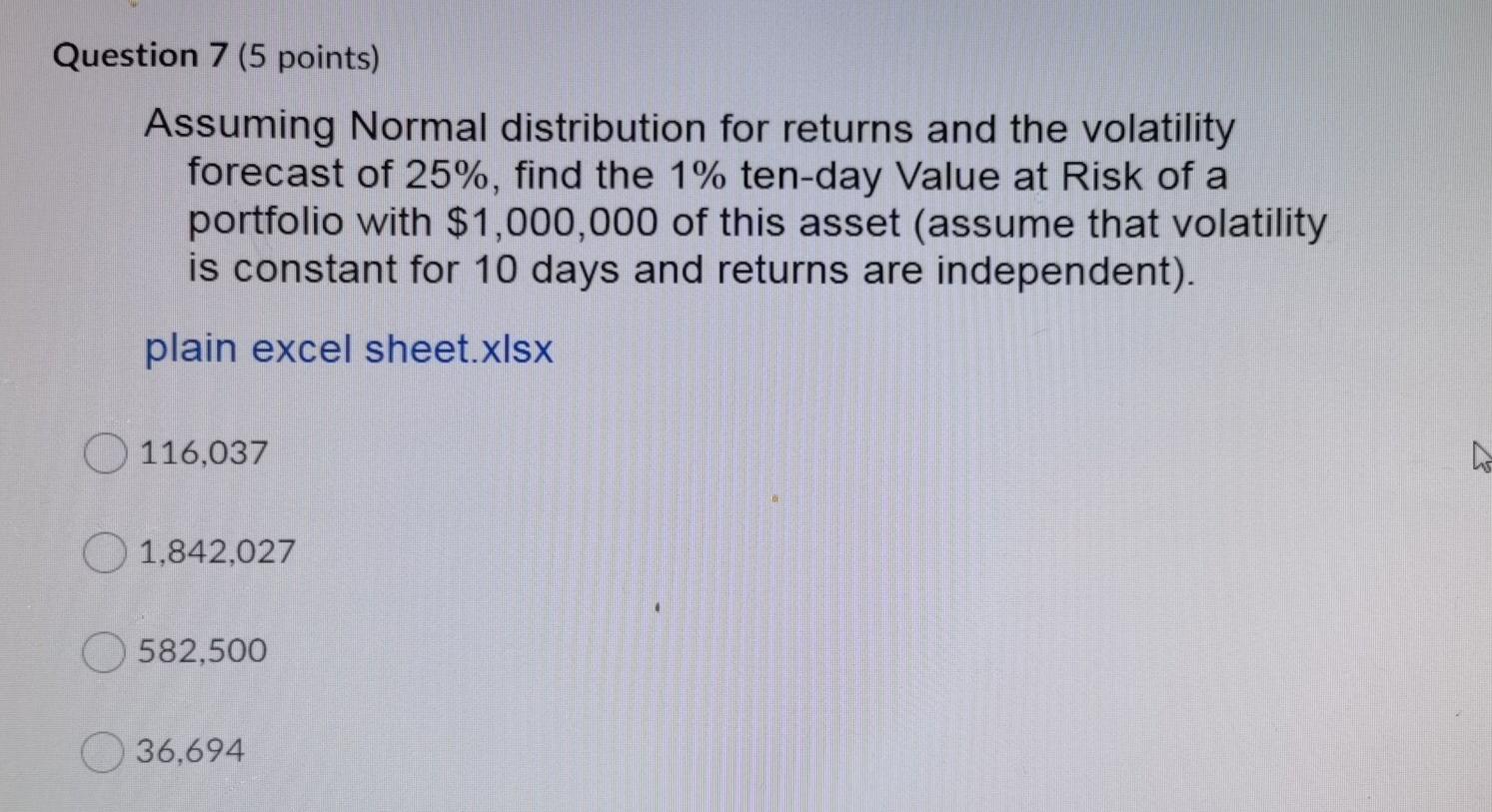

In the VLAB GJR-GARCH model for Microsoft, volatility, parameters and t-statistics are given below. If the stock falls by 5% today (May 5), what will be forecast for volatility the next day, May 6? Volatility Prediction for Tuesday, May 5th, 2020: 49.31% (-1.72%) Parameter Estimates param t-stat 0.000005, 13 16 0.03 0.92 488 0.05 10 Y plain excel sheet.xlsx Question 7 (5 points) Assuming Normal distribution for returns and the volatility forecast of 25%, find the 1% ten-day Value at Risk of a portfolio with $1,000,000 of this asset (assume that volatility is constant for 10 days and returns are independent). plain excel sheet.xlsx O 116,037 ho 1,842,027 582,500 36,694

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts