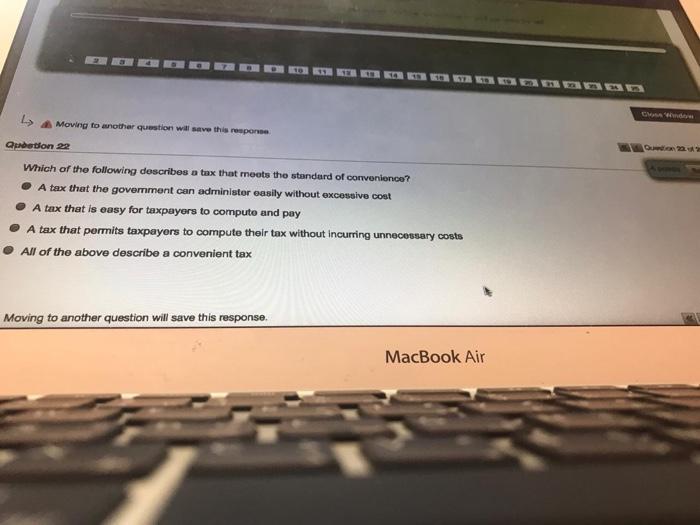

Question: Moving to another question will save this response Question 22 Which of the following describes a tax that meets the standard of convenience? A tax

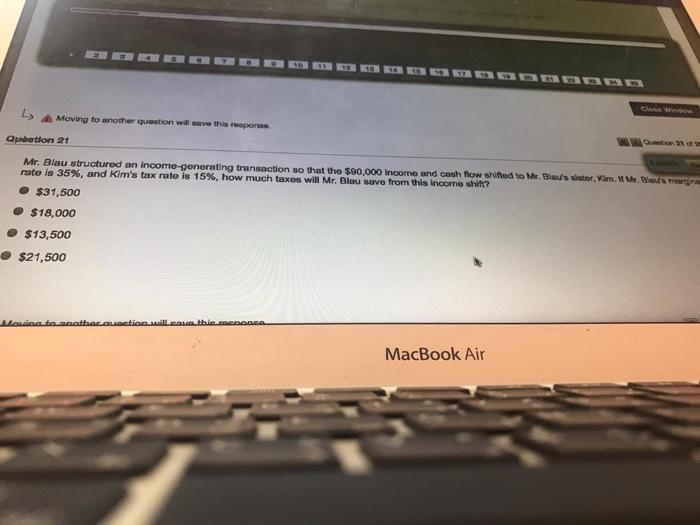

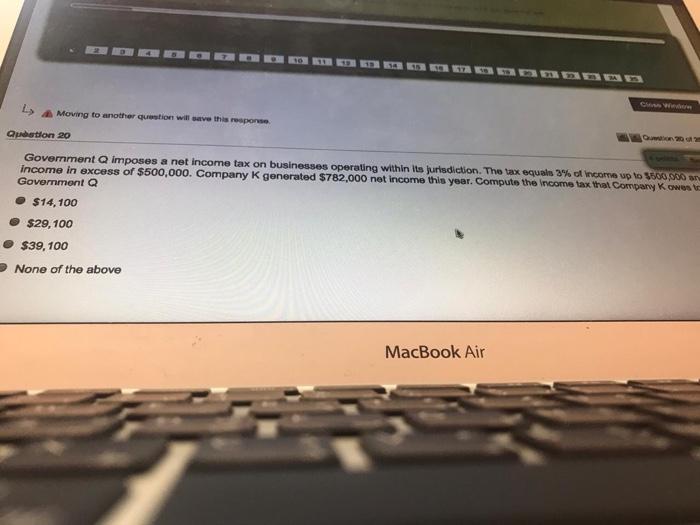

Moving to another question will save this response Question 22 Which of the following describes a tax that meets the standard of convenience? A tax that the government can administer easily without excessive cost - A tax that is easy for taxpayers to computo and pay A tax that permits taxpayers to compute their tax without incurring unnecessary costs All of the above describe a convenient tax Moving to another question will save this response. MacBook Air Moving to another question will save the response Qurbation 21 Mr. Blau structured an income-generating transaction so that the $90,000 Income and cash flow shifted to Mr. Blau's, lade rate is 35%, and Kim's tax rate is 15%, how much taxes will Mr. Blou sove from this income shift? $31,500 $18,000 $13,500 $21,500 Mandag.tagnatbarauation will come the DBADDA MacBook Air L> Moving to another question will save this response Quatlon 20 Government Q imposes a net income tax on businesses operating within its jurisdiction. The tax equal 3% of income up to 5300 Income in excess of $500,000. Company K generated $782,000 not income this year. Compute the income tax that compare Government Q $14, 100 $29, 100 $39, 100 None of the above MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts