Question: Note: If the image appears too small you can right-click it and open it in a new tab to better see the information :) Boyd

Note: If the image appears too small you can right-click it and open it in a new tab to better see the information :)

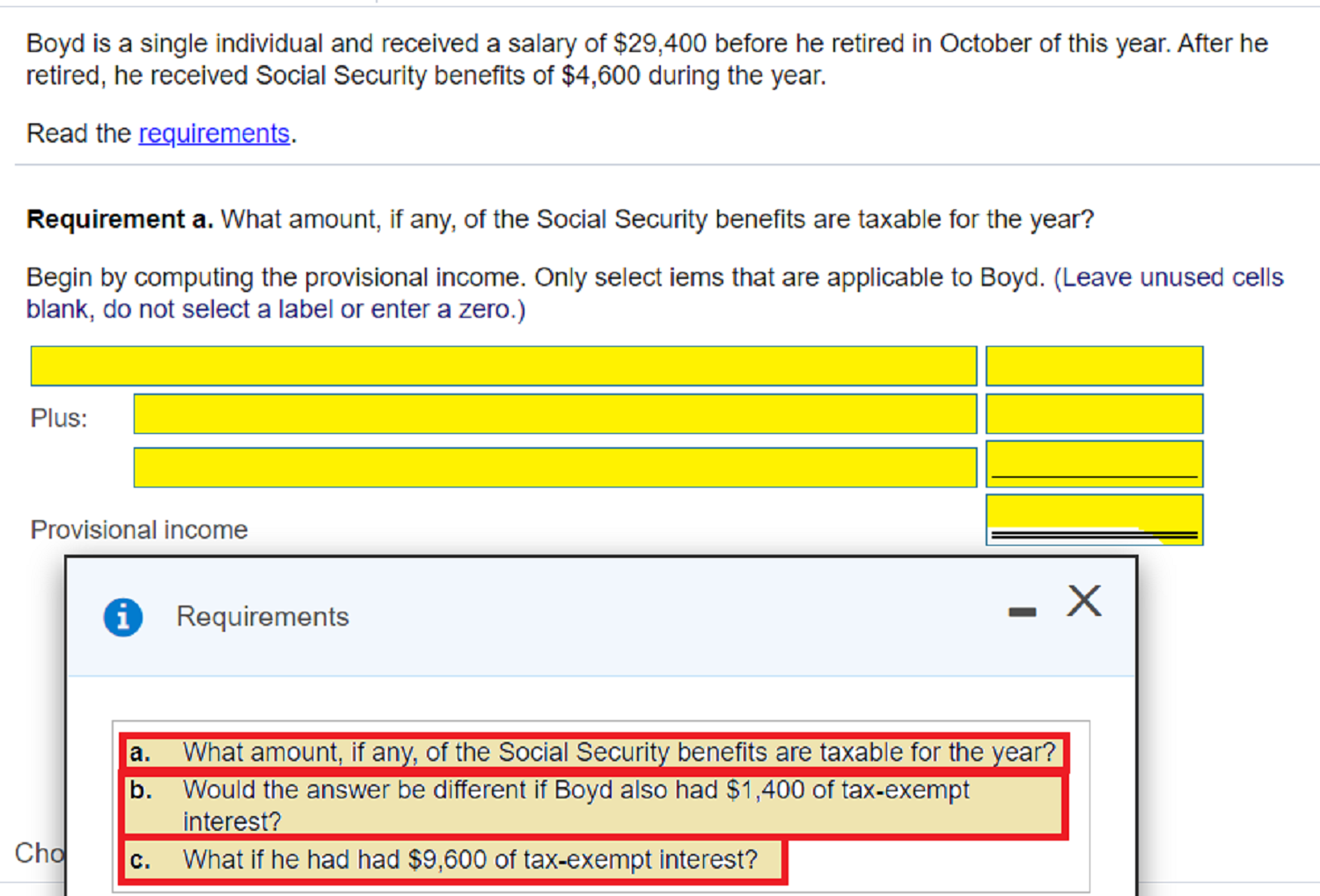

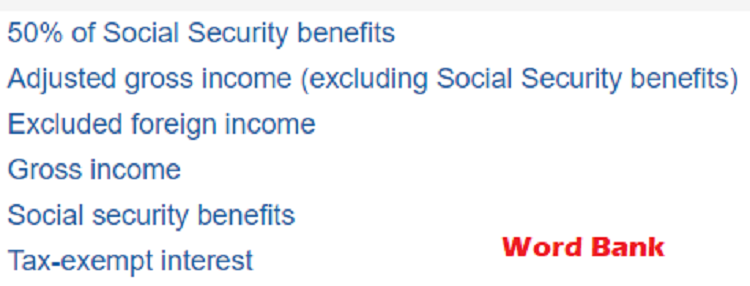

Boyd is a single individual and received a salary of $29,400 before he retired in October of this year. After he retired, he received Social Security benefits of $4,600 during the year. Read the requirements. Requirement a. What amount, if any, of the Social Security benefits are taxable for the year? Begin by computing the provisional income. Only select iems that are applicable to Boyd. (Leave unused cells blank, do not select a label or enter a zero.) Plus: Provisional income i Requirements -X a. b. What amount, if any, of the Social Security benefits are taxable for the year? Would the answer be different if Boyd also had $1,400 of tax-exempt interest? What if he had had $9,600 of tax-exempt interest? Cho C. 50% of Social Security benefits Adjusted gross income (excluding Social Security benefits) Excluded foreign income Gross income Social security benefits Word Bank Tax-exempt interest

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts