Question: Old MathJax webview Old MathJax webview Old MathJax webview Hello, that's all the instructions or information. That's all the information. please I needed this answer

Old MathJax webview

Hello, that's all the instructions or information.

That's all the information. please I needed this answer it due today

please just fill the template with figures, do it like yours, follow the steps

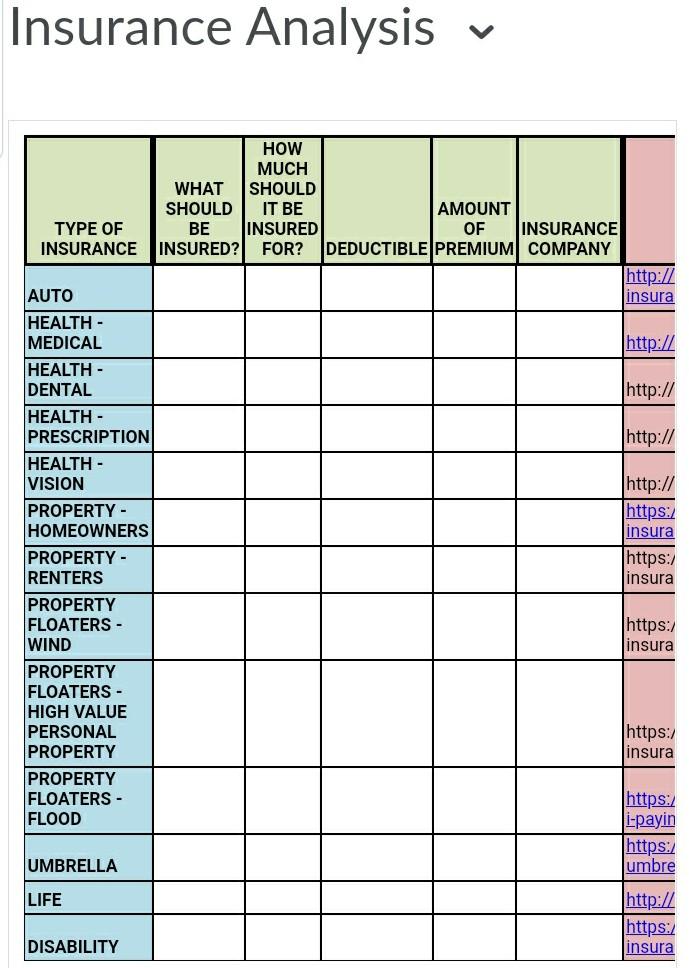

Purpose: To develop a personal risk management plan utilizing various forms of insurance. Instructions: Consider the risks involved in your life. You will want to protect those items that retain value and create value for you. Using the Excel template provided, assess what forms of insurance you need as well as the monthly cost to you in premiums Insurance Analysis HOW MUCH WHAT SHOULD SHOULD IT BE AMOUNT TYPE OF BE INSURED OF INSURANCE INSURANCE INSURED? FOR? DEDUCTIBLE PREMIUM COMPANY |http:// AUTO insura HEALTH - MEDICAL http:// HEALTH - DENTAL |http:// HEALTH - PRESCRIPTION |http:// HEALTH - VISION |http:// PROPERTY - https:/ HOMEOWNERS insura PROPERTY - https:/ RENTERS insura PROPERTY FLOATERS - https:/ WIND insura PROPERTY FLOATERS - HIGH VALUE PERSONAL https: PROPERTY insura PROPERTY FLOATERS - https:/ FLOOD i-payin https:/ UMBRELLA umbre LIFE |http:// https: insura DISABILITY Chapters 10-12. Insurance is a protection against possible financial loss. We often find comfort in having health, disability, home or renter's, and car insurance to help during expected and unexpected times. Home and auto insurance may be needed to protect yourself. Factors that affect home insurance costs includes the home location, type of structure, coverage amount, and policy type. A brick house will cost less than a wooden one, for instance. Before you think that insurance is not necessary, consider the risks. If there is a fire, theft, wind, natural disaster, like a hurricane, storm, flood, or even a wiring are all good reasons to consider insuring your property and belongings. Take inventory of your belongings and continue to assess as you make purchases. You'll want to value the contents to determine the amount of coverage needed. Shop price comparisons and ask for discounts. Discounts can be applied based on if you have a fire alarm, include 2 cars or a home and a car insured with same insurance company; if you are a student or a non-smoker you might take advantage of discounts. For auto insurance, insured with same insurance company; if you are a student or a non-smoker you might take advantage of discounts. For auto insurance, coverage falls into two parts, bodily and property. Take note of protections, like collision, uninsured motorist protections and no fault insurance. It might sound ridiculous to have coverage when someone else doesn't, but imagine if you get in a wreck with someone who a doesn't have coverage, like a teen who decides to go for a joyride or a person who loses coverage because he or she cannot afford it after job loss. Insurance gives peace of mind. Rates can be compared at NetQuote. Next, let's talk about health insurance. Coverage often has three types of expenses: Hospital, surgical, and physician. A good health plan should include coverage for hospital and doctor bills, 120 days hospital stay, $1 million lifetime max for each family member, pays 80% plus out-of-hospital expenses after annual deductible of $1000 per person, and out-of- pocket expenses should not exceed $6000. The Purpose: To develop a personal risk management plan utilizing various forms of insurance. Instructions: Consider the risks involved in your life. You will want to protect those items that retain value and create value for you. Using the Excel template provided, assess what forms of insurance you need as well as the monthly cost to you in premiums Insurance Analysis HOW MUCH WHAT SHOULD SHOULD IT BE AMOUNT TYPE OF BE INSURED OF INSURANCE INSURANCE INSURED? FOR? DEDUCTIBLE PREMIUM COMPANY |http:// AUTO insura HEALTH - MEDICAL http:// HEALTH - DENTAL |http:// HEALTH - PRESCRIPTION |http:// HEALTH - VISION |http:// PROPERTY - https:/ HOMEOWNERS insura PROPERTY - https:/ RENTERS insura PROPERTY FLOATERS - https:/ WIND insura PROPERTY FLOATERS - HIGH VALUE PERSONAL https: PROPERTY insura PROPERTY FLOATERS - https:/ FLOOD i-payin https:/ UMBRELLA umbre LIFE |http:// https: insura DISABILITY Chapters 10-12. Insurance is a protection against possible financial loss. We often find comfort in having health, disability, home or renter's, and car insurance to help during expected and unexpected times. Home and auto insurance may be needed to protect yourself. Factors that affect home insurance costs includes the home location, type of structure, coverage amount, and policy type. A brick house will cost less than a wooden one, for instance. Before you think that insurance is not necessary, consider the risks. If there is a fire, theft, wind, natural disaster, like a hurricane, storm, flood, or even a wiring are all good reasons to consider insuring your property and belongings. Take inventory of your belongings and continue to assess as you make purchases. You'll want to value the contents to determine the amount of coverage needed. Shop price comparisons and ask for discounts. Discounts can be applied based on if you have a fire alarm, include 2 cars or a home and a car insured with same insurance company; if you are a student or a non-smoker you might take advantage of discounts. For auto insurance, insured with same insurance company; if you are a student or a non-smoker you might take advantage of discounts. For auto insurance, coverage falls into two parts, bodily and property. Take note of protections, like collision, uninsured motorist protections and no fault insurance. It might sound ridiculous to have coverage when someone else doesn't, but imagine if you get in a wreck with someone who a doesn't have coverage, like a teen who decides to go for a joyride or a person who loses coverage because he or she cannot afford it after job loss. Insurance gives peace of mind. Rates can be compared at NetQuote. Next, let's talk about health insurance. Coverage often has three types of expenses: Hospital, surgical, and physician. A good health plan should include coverage for hospital and doctor bills, 120 days hospital stay, $1 million lifetime max for each family member, pays 80% plus out-of-hospital expenses after annual deductible of $1000 per person, and out-of- pocket expenses should not exceed $6000. TheStep by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts