Question: Old MathJax webview please do it in 10 minutes will upvote no option here please do Q9 9. A stock price (which pays no dividends)

Old MathJax webview

please do it in 10 minutes will upvote

no option here please do Q9

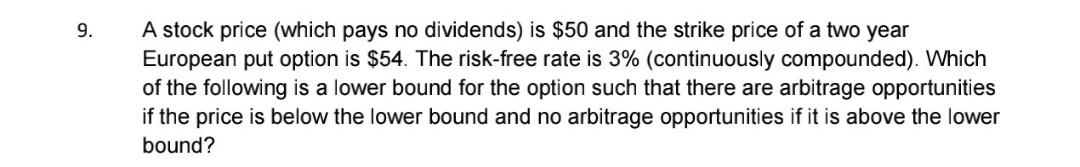

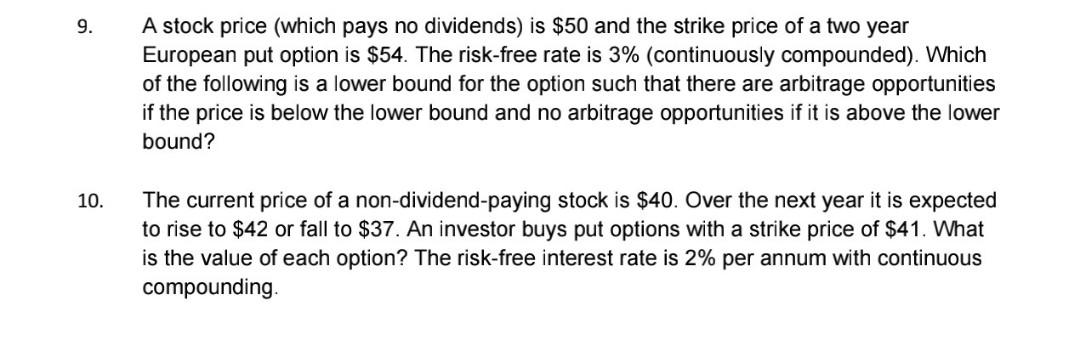

9. A stock price (which pays no dividends) is $50 and the strike price of a two year European put option is $54. The risk-free rate is 3% (continuously compounded). Which of the following is a lower bound for the option such that there are arbitrage opportunities if the price is below the lower bound and no arbitrage opportunities if it is above the lower bound? 9. A stock price (which pays no dividends) is $50 and the strike price of a two year European put option is $54. The risk-free rate is 3% (continuously compounded). Which of the following is a lower bound for the option such that there are arbitrage opportunities if the price is below the lower bound and no arbitrage opportunities if it is above the lower bound? 10. The current price of a non-dividend-paying stock is $40. Over the next year it is expected to rise to $42 or fall to $37. An investor buys put options with a strike price of $41. What is the value of each option? The risk-free interest rate is 2% per annum with continuous compounding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts