Question: please answer all questions All final answers must be rounded to the nearest $10 26. Which, if any, of the listed taxes are not allowable

please answer all questions

All final answers must be rounded to the nearest $10

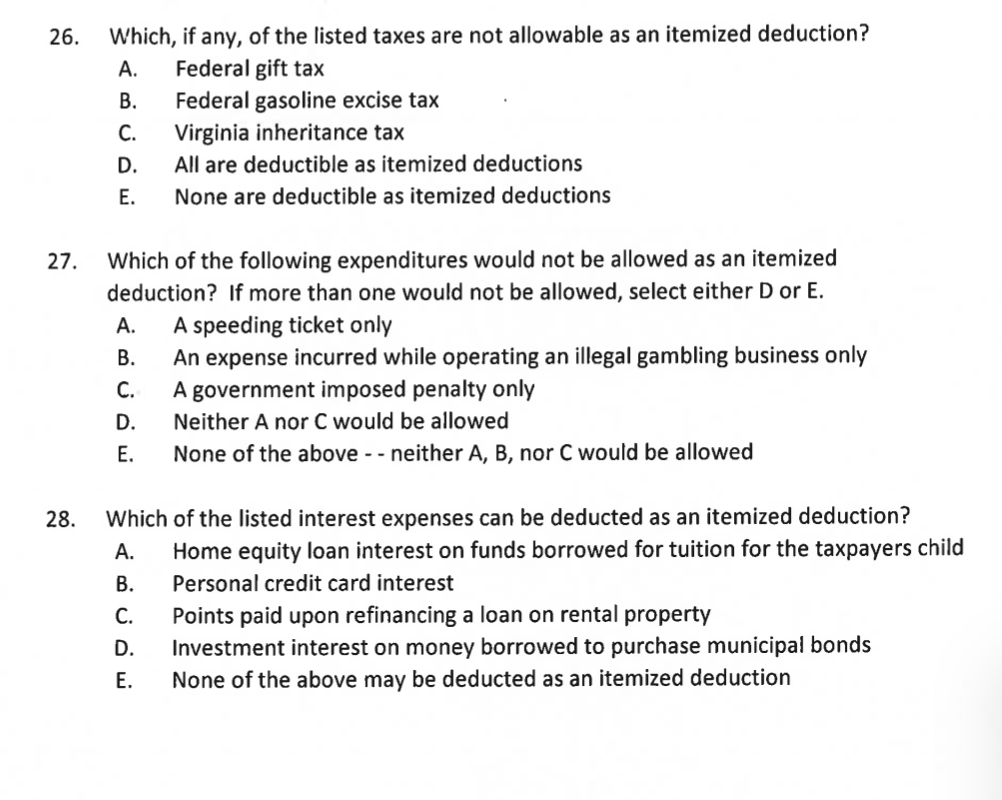

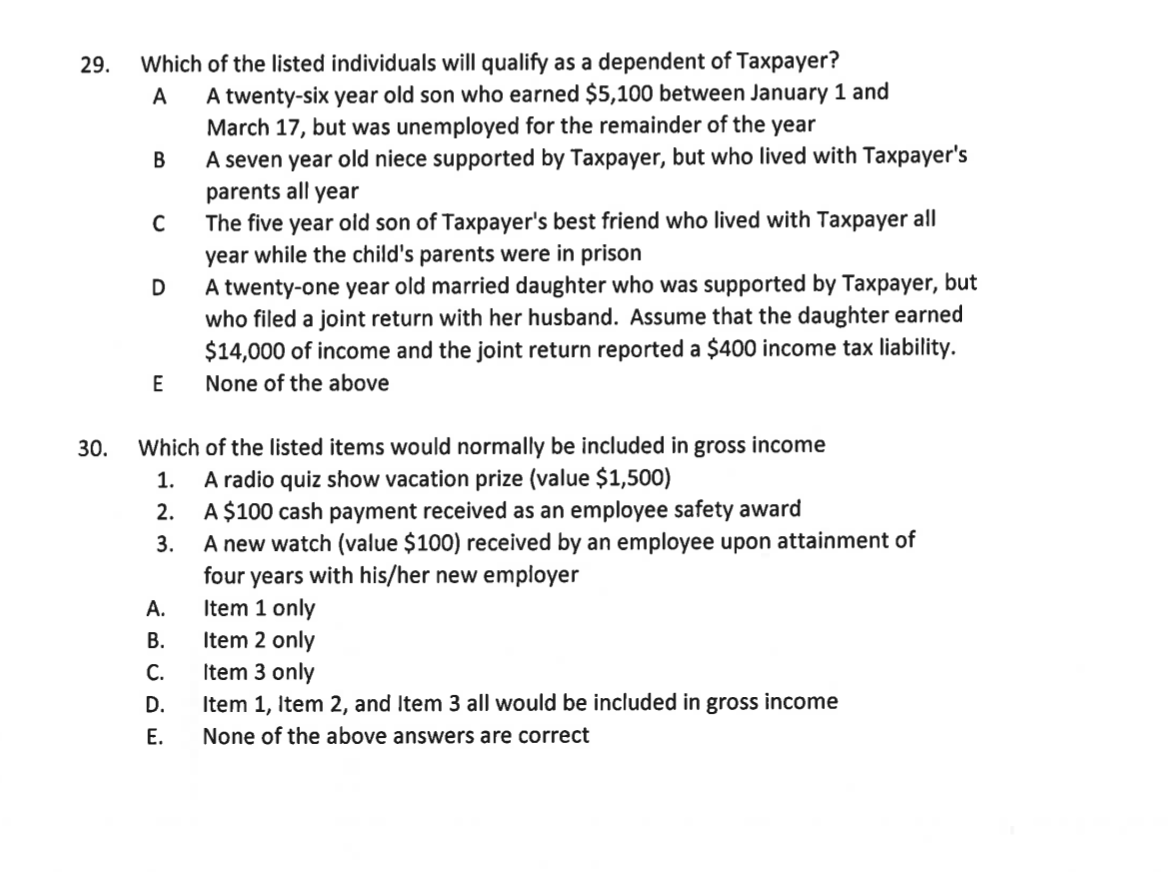

26. Which, if any, of the listed taxes are not allowable as an itemized deduction? A. Federal gift tax B. Federal gasoline excise tax C. Virginia inheritance tax D. All are deductible as itemized deductions E. None are deductible as itemized deductions 27. Which of the following expenditures would not be allowed as an itemized deduction? If more than one would not be allowed, select either D or E. A. A speeding ticket only B. An expense incurred while operating an illegal gambling business only C. A government imposed penalty only D. Neither A nor C would be allowed E. None of the above -- neither A, B, nor C would be allowed 28. Which of the listed interest expenses can be deducted as an itemized deduction? A. Home equity loan interest on funds borrowed for tuition for the taxpayers child Personal credit card interest C. Points paid upon refinancing a loan on rental property D. Investment interest on money borrowed to purchase municipal bonds E. None of the above may be deducted as an itemized deduction 29. Which of the listed individuals will qualify as a dependent of Taxpayer? A A twenty-six year old son who earned $5,100 between January 1 and March 17, but was unemployed for the remainder of the year B A seven year old niece supported by Taxpayer, but who lived with Taxpayer's parents all year The five year old son of Taxpayer's best friend who lived with Taxpayer all year while the child's parents were in prison A twenty-one year old married daughter who was supported by Taxpayer, but who filed a joint return with her husband. Assume that the daughter earned $14,000 of income and the joint return reported a $400 income tax liability. None of the above D E 30. Which of the listed items would normally be included in gross income 1. A radio quiz show vacation prize (value $1,500) 2. A $100 cash payment received as an employee safety award 3. A new watch (value $100) received by an employee upon attainment of four years with his/her new employer Item 1 only B. Item 2 only Item 3 only D. Item 1, Item 2, and Item 3 all would be included in gross income E. None of the above answers are correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts