Question: Please note that all final answers have been rounded to the nearest $10. If a problem requires multiple computations, round nothing until attaining the final

Please note that all final answers have been rounded to the nearest $10. If a problem requires multiple computations, round nothing until attaining the final answer and then round it to the nearest $10.

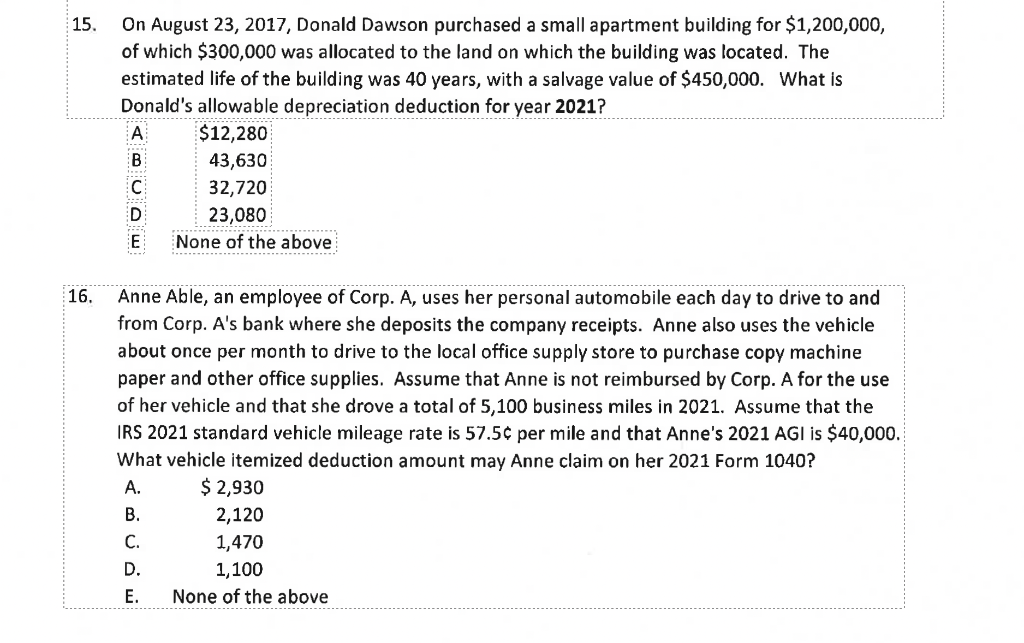

15. On August 23,2017 , Donald Dawson purchased a small apartment building for $1,200,000, of which $300,000 was allocated to the land on which the building was located. The estimated life of the building was 40 years, with a salvage value of $450,000. What is Donald's allowable depreciation deduction for year 2021 ? 6. Anne Able, an employee of Corp. A, uses her personal automobile each day to drive to and from Corp. A's bank where she deposits the company receipts. Anne also uses the vehicle about once per month to drive to the local office supply store to purchase copy machine paper and other office supplies. Assume that Anne is not reimbursed by Corp. A for the use of her vehicle and that she drove a total of 5,100 business miles in 2021. Assume that the IRS 2021 standard vehicle mileage rate is 57.54 per mile and that Anne's 2021AGI is $40,000. What vehicle itemized deduction amount may Anne claim on her 2021 Form 1040 ? A. $2,930 B. 2,120 C. 1,470 D. 1,100 E. None of the above 15. On August 23,2017 , Donald Dawson purchased a small apartment building for $1,200,000, of which $300,000 was allocated to the land on which the building was located. The estimated life of the building was 40 years, with a salvage value of $450,000. What is Donald's allowable depreciation deduction for year 2021 ? 6. Anne Able, an employee of Corp. A, uses her personal automobile each day to drive to and from Corp. A's bank where she deposits the company receipts. Anne also uses the vehicle about once per month to drive to the local office supply store to purchase copy machine paper and other office supplies. Assume that Anne is not reimbursed by Corp. A for the use of her vehicle and that she drove a total of 5,100 business miles in 2021. Assume that the IRS 2021 standard vehicle mileage rate is 57.54 per mile and that Anne's 2021AGI is $40,000. What vehicle itemized deduction amount may Anne claim on her 2021 Form 1040 ? A. $2,930 B. 2,120 C. 1,470 D. 1,100 E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts