Question: please answer all questions completely using multiple choice. Which of the following statements is FALSE? Correlation is the expected product of the deviations of two

please answer all questions completely using multiple choice.

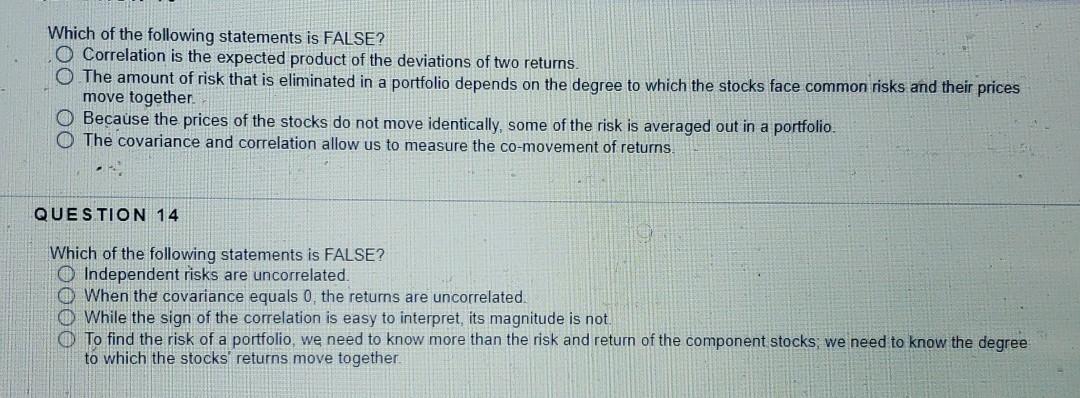

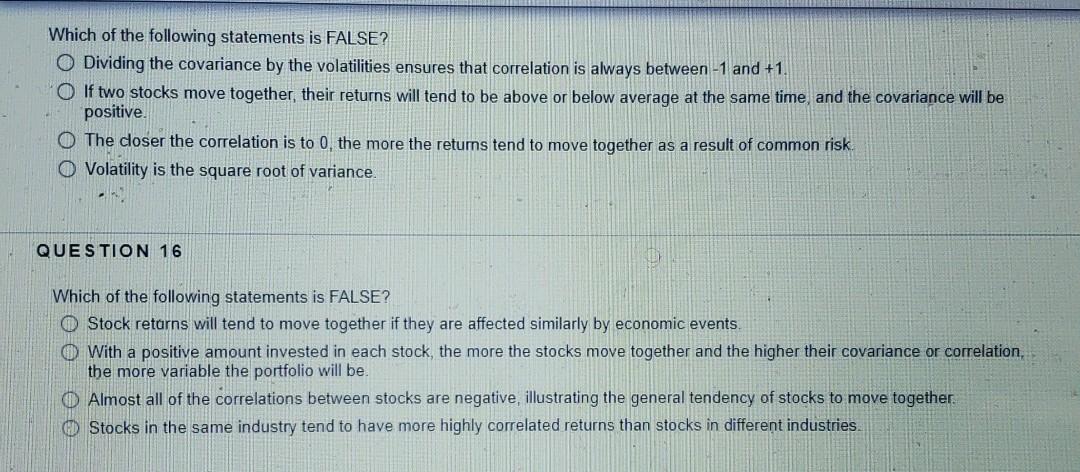

Which of the following statements is FALSE? Correlation is the expected product of the deviations of two returns The amount of risk that is eliminated in a portfolio depends on the degree to which the stocks face common risks and their prices move together. O Because the prices of the stocks do not move identically, some of the risk is averaged out in a portfolio. O The covariance and correlation allow us to measure the co-movement of returns QUESTION 14 Which of the following statements is FALSE? Independent risks are uncorrelated When the covariance equals 0the returns are uncorrelated O While the sign of the correlation is easy to interpret, its magnitude is not. To find the risk of a portfolio, we need to know more than the risk and return of the component stocks, we need to know the degree to which the stocks' returns move together Which of the following statements is FALSE? O Dividing the covariance by the volatilities ensures that correlation is always between-1 and +1. O If two stocks move together, their returns will tend to be above or below average at the same time, and the covariance will be positive. O The closer the correlation is to 0, the more the retums tend to move together as a result of common risk O Volatility is the square root of variance QUESTION 16 Which of the following statements is FALSE? Stock returns will tend to move together if they are affected similarly by economic events. O With a positive amount invested in each stock, the more the stocks move together and the higher their covariance or correlation, the more variable the portfolio will be. Almost all of the correlations between stocks are negative, illustrating the general tendency of stocks to move together. Stocks in the same industry tend to have more highly correlated returns than stocks in different industries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts