Question: 2. please answer questions completely using multiple choice. Which of the following statements is FALSE? O The project's NPV represents the value to the new

2.

please answer questions completely using multiple choice.

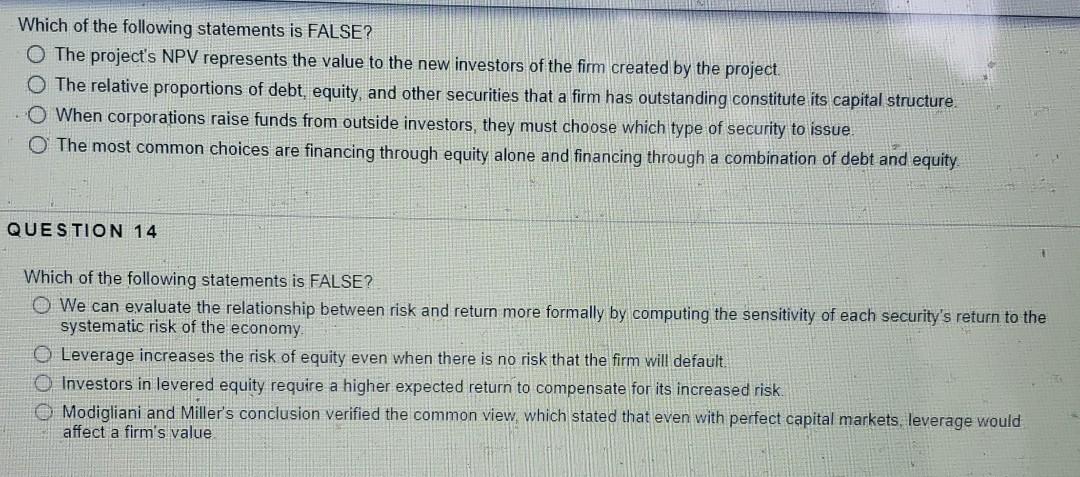

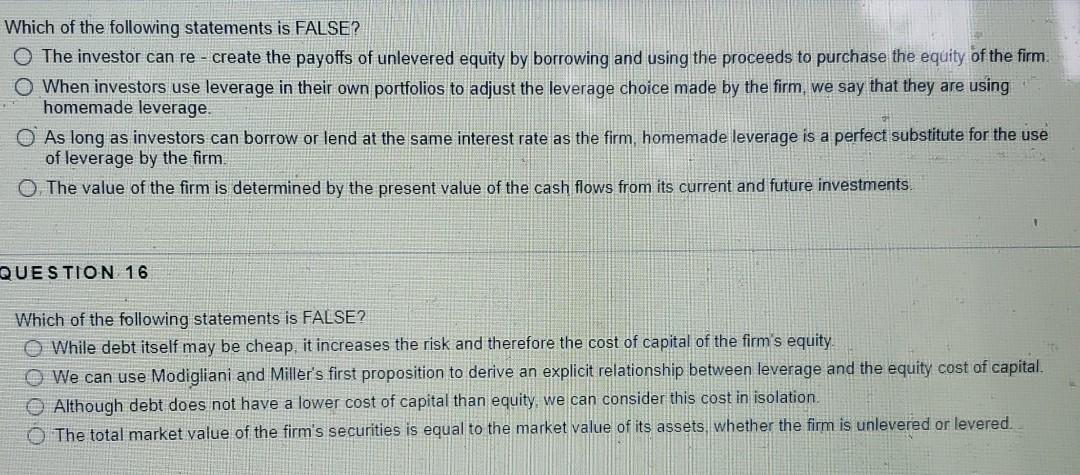

Which of the following statements is FALSE? O The project's NPV represents the value to the new investors of the firm created by the project. The relative proportions of debt, equity, and other securities that a firm has outstanding constitute its capital structure When corporations raise funds from outside investors, they must choose which type of security to issue. O The most common choices are financing through equity alone and financing through a combination of debt and equity QUESTION 14 Which of the following statements is FALSE? O We can evaluate the relationship between risk and return more formally by computing the sensitivity of each security's return to the systematic risk of the economy Leverage increases the risk of equity even when there is no risk that the firm will default. Investors in levered equity require a higher expected return to compensate for its increased risk. Modigliani and Miller's conclusion verified the common view, which stated that even with perfect capital markets, leverage would affect a firm's value Which of the following statements is FALSE? The investor can re - create the payoffs of unlevered equity by borrowing and using the proceeds to purchase the equity of the firm. O When investors use leverage in their own portfolios to adjust the leverage choice made by the firm, we say that they are using homemade leverage. O As long as investors can borrow or lend at the same interest rate as the firm, homemade leverage is a perfect substitute for the use of leverage by the firm, The value of the firm is determined by the present value of the cash flows from its current and future investments QUESTION 16 Which of the following statements is FALSE? e While debt itself may be cheap, it increases the risk and therefore the cost of capital of the firm's equity O We can use Modigliani and Miller's first proposition to derive an explicit relationship between leverage and the equity cost of capital. Although debt does not have a lower cost of capital than equity, we can consider this cost in isolation The total market value of the firm's securities is equal to the market value of its assets, whether the firm is unlevered or levered

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts