Question: 2. 3. please answer questions completely using multiple choice. Which of the following statements is false? O With tax-deductible interest, the effective after-tax borrowing rate

2.

3.

please answer questions completely using multiple choice.

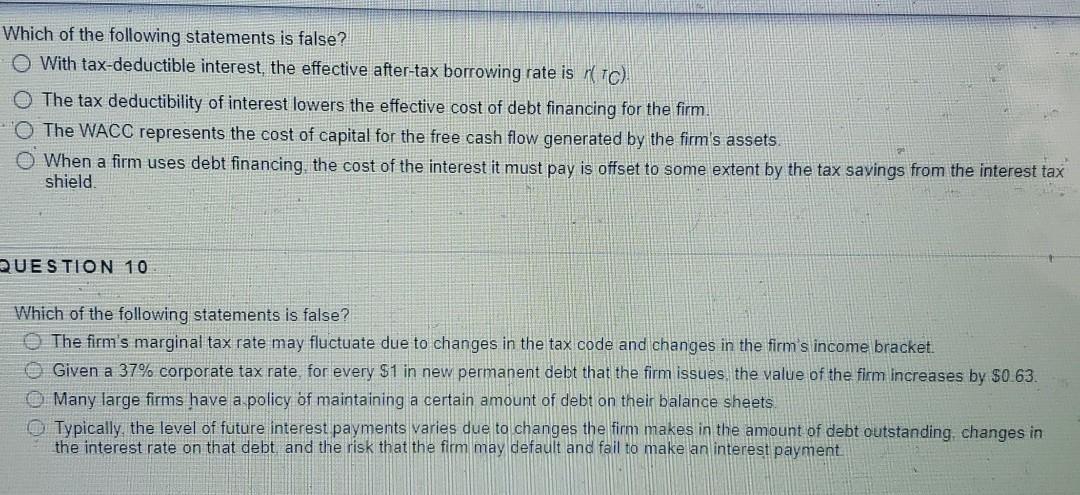

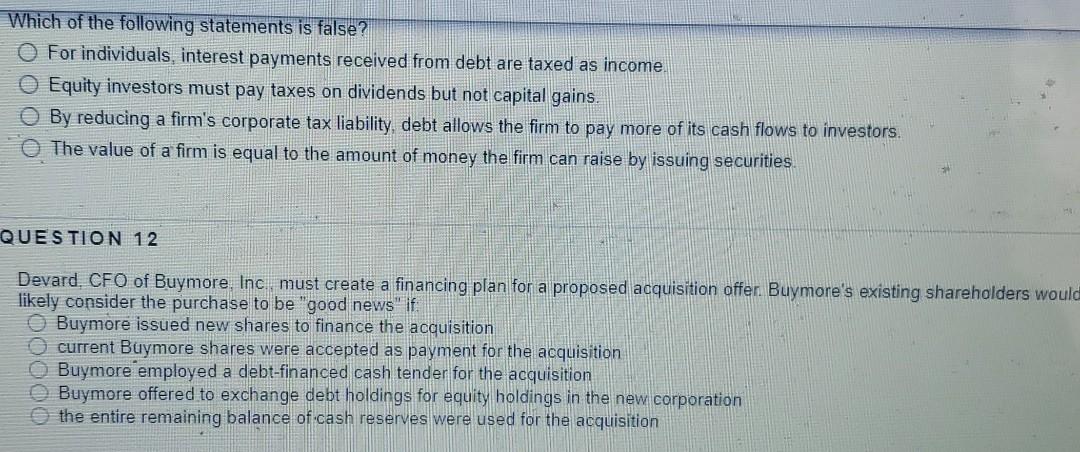

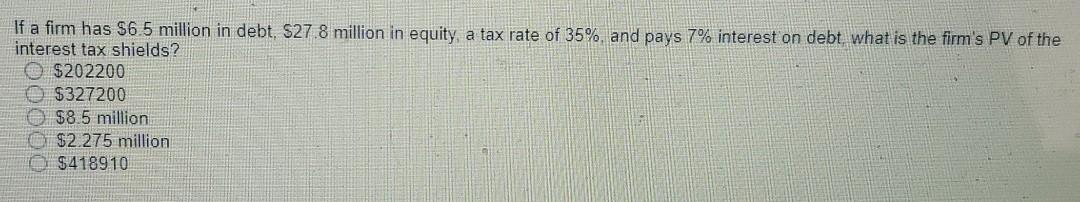

Which of the following statements is false? O With tax-deductible interest, the effective after-tax borrowing rate is 1C) O The tax deductibility of interest lowers the effective cost of debt financing for the firm. The WACC represents the cost of capital for the free cash flow generated by the firm's assets When a firm uses debt financing the cost of the interest it must pay is offset to some extent by the tax savings from the interest tax shield QUESTION 10 Which of the following statements is false? The firm's marginal tax rate may fluctuate due to changes in the tax code and changes in the firm's income bracket. Given a 37% corporate tax rate, for every $1 in new permanent debt that the firm issues, the value of the firm increases by $0.63. Many large firms have a policy of maintaining a certain amount of debt on their balance sheets Typically, the level of future interest payments varies due to changes the firm makes in the amount of debt outstanding, changes in the interest rate on that debt and the risk that the firm may default and fail to make an interest payment Which of the following statements is false? O For individuals, interest payments received from debt are taxed as income. O Equity investors must pay taxes on dividends but not capital gains. By reducing a firm's corporate tax liability, debt allows the firm to pay more of its cash flows to investors. The value of a firm is equal to the amount of money the firm can raise by issuing securities QUESTION 12 Devard. CFO of Buymore. Inc must create a financing plan for a proposed acquisition offer. Buymore's existing shareholders would likely consider the purchase to be "good news" if Buymore issued new shares to finance the acquisition current Buymore shares were accepted as payment for the acquisition Buymore employed a debt-financed cash tender for the acquisition Buymore offered to exchange debt holdings for equity holdings in the new corporation the entire remaining balance of cash reserves were used for the acquisition DO000 If a firm has $6.5 million in debt, $27.8 million in equity, a tax rate of 35%, and pays 7% interest on debt what is the firm's PV of the interest tax shields? $202200 $327200 $8.5 million $2.275 million $418910

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts