Question: please answer these questions, for the ones with numbers please show excel formulas to solve. a) What is meant by a long position and a

please answer these questions, for the ones with numbers please show excel formulas to solve.

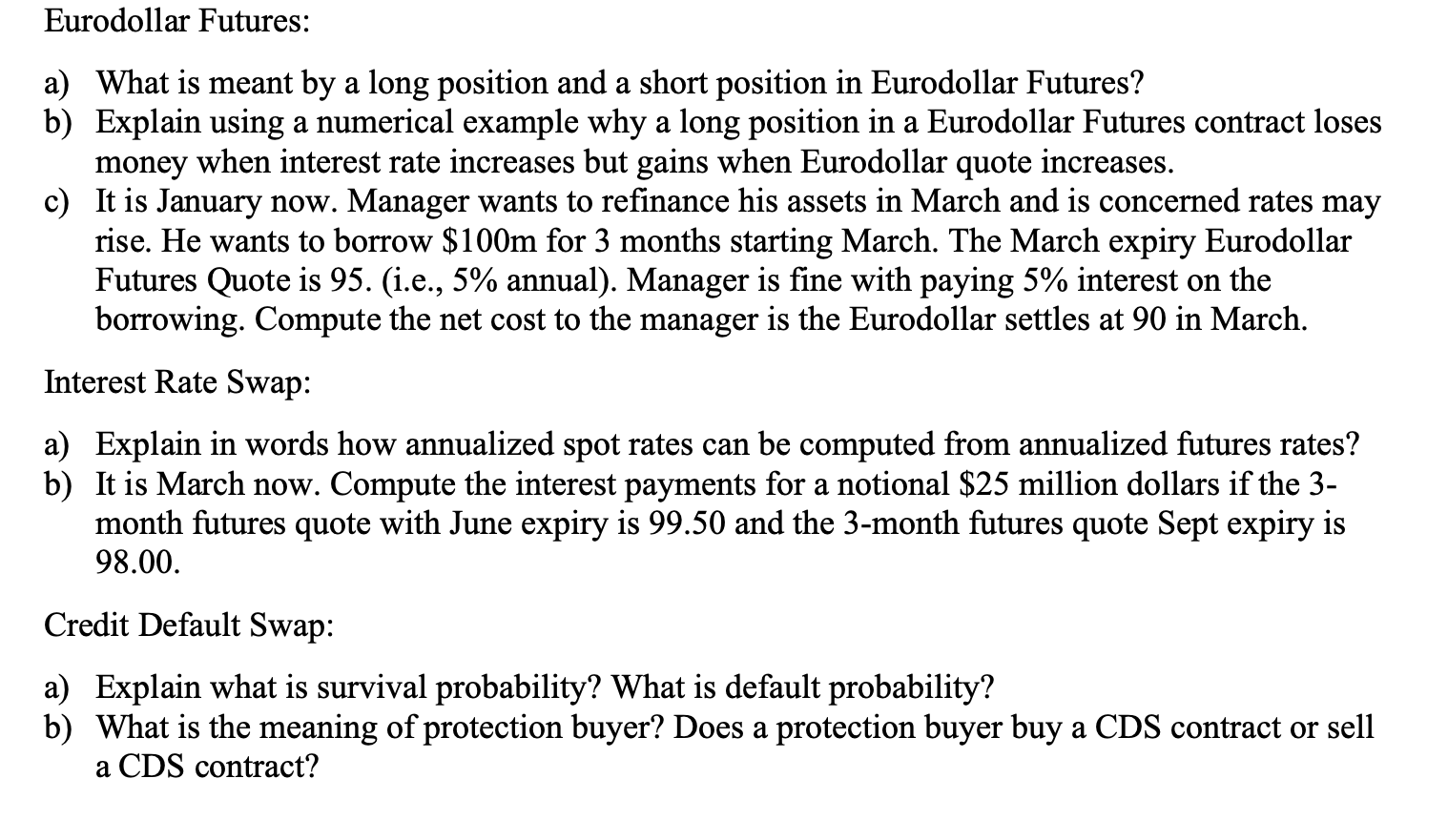

a) What is meant by a long position and a short position in Eurodollar Futures? b) Explain using a numerical example why a long position in a Eurodollar Futures contract loses money when interest rate increases but gains when Eurodollar quote increases. c) It is January now. Manager wants to refinance his assets in March and is concerned rates may rise. He wants to borrow $100m for 3 months starting March. The March expiry Eurodollar Futures Quote is 95 . (i.e., 5% annual). Manager is fine with paying 5% interest on the borrowing. Compute the net cost to the manager is the Eurodollar settles at 90 in March. Interest Rate Swap: a) Explain in words how annualized spot rates can be computed from annualized futures rates? b) It is March now. Compute the interest payments for a notional $25 million dollars if the 3month futures quote with June expiry is 99.50 and the 3-month futures quote Sept expiry is 98.00. Credit Default Swap: a) Explain what is survival probability? What is default probability? b) What is the meaning of protection buyer? Does a protection buyer buy a CDS contract or sell a CDS contract

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts