Question: Several years ago, Carlos formed Marzan Enterprises, a retail company. Marzan uses the accrual method of accounting. In the current year, the corporation reported

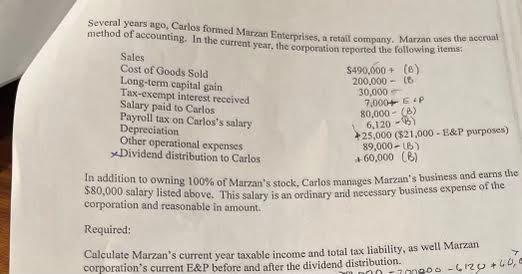

Several years ago, Carlos formed Marzan Enterprises, a retail company. Marzan uses the accrual method of accounting. In the current year, the corporation reported the following items: Sales Cost of Goods Sold Long-term capital gain Tax-exempt interest received Salary paid to Carlos Payroll tax on Carlos's salary Depreciation Other operational expenses. Dividend distribution to Carlos $490,000+ (6) 200,000 (6 30,000 7,000+ P 80,000 (8) 6,120- 25,000 ($21,000 - E&P purposes) 89,000 LB) +60,000 (B) In addition to owning 100% of Marzan's stock, Carlos manages Marzan's business and earns the $80,000 salary listed above. This salary is an ordinary and necessary business expense of the corporation and reasonable in amount. Required: Calculate Marzan's current year taxable income and total tax liability, as well Marzan corporation's current E&P before and after the dividend distribution. 7 0007000 -6120 + 40,0

Step by Step Solution

3.57 Rating (154 Votes )

There are 3 Steps involved in it

Income Statement Amount Sales 490000 Cost of Goods Sold 20... View full answer

Get step-by-step solutions from verified subject matter experts