Question: please explain step by step with formuls please answer thoroughly with formulas Garden Depot is a retalier that is preporng ts bueget for the upcoming

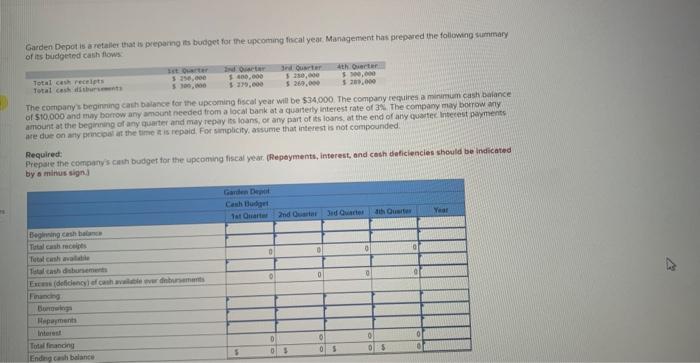

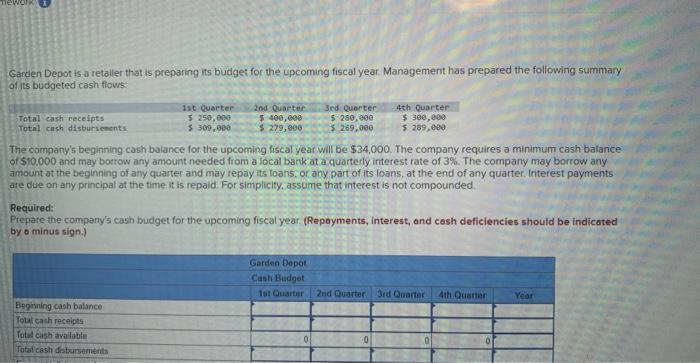

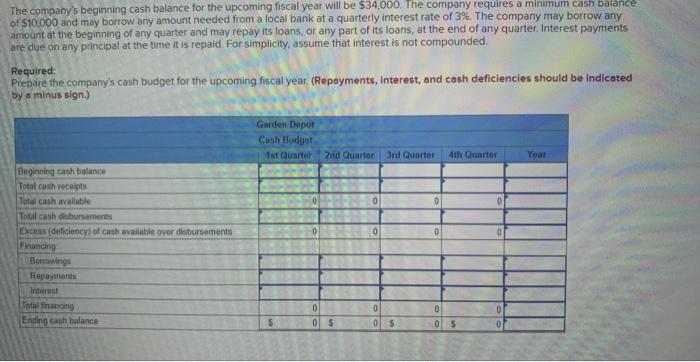

Garden Depot is a retalier that is preporng ts bueget for the upcoming focal year Managentent has prepared the followng summary of its budgeted cash flows The company s beginming cash balance for the upcoming fiscal year witl be 534,000 . The company repuires a minumum cash balance of \$10,000 and may barrow any amoont nceded from a local boek at a quarteriy interest rate of are due on any principer ar the time it is repaid. For semplicity. assume that interest is not compounded. Aequired: Preoue the company s canh budget tor the upcoming fiscal year. (Repeyments, interest, and cosh daticiencies should be indicated Required: Garden Depot is a retailer that is preparing its budget for the upcoming fiscal year. Management has prepared the following summary of its budgeted cash flows. The company's begining cash balance for the upcoming fiscal year will be $34,000. The company requires a minimum cash balance of $10.000 and may borrow any amount needed from a local bank at a quarterly interest rate of 3%. The company may borrow any amount at the beginning of any quarter and may repay its loans. or any part of its loans, at the end of any quarter. Interest payments are due on any principal at the time it is repaid. For simplicity, assume that interest is not compounded. Required: Prepare the company's cash budget for the upcoming fiscal year. (Repayments, interest, and cash deficiencies should be indicated by a minus sign.) The company's beginning cash balance for the upcoming fiscal year will be $34,000. The company requires a minimum cash balance of $10,000 and may botrow any amount needed from a local bank at a quarterly interest rate of 3%. The company may borrow any amount at the beginning of any quarter and may repay its loans, or any part of its loans, at the end of any quarter. Interest payments are due on any principal at the time it is repaid. For simplicity, assume that interest is not compounded. Required: Prepare the company's cash budget for the upcoming fiscal year. (Repayments, interest, and cash deficiencies should be indicated by o minus sign.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts