Question: PLEASE LIST ALL STEPS FOR EACH STEP BELOW IN DETAIL 2 Use the STDEV.S function to calculate the standard deviation between the current values of

PLEASE LIST ALL STEPS FOR EACH STEP BELOW IN DETAIL

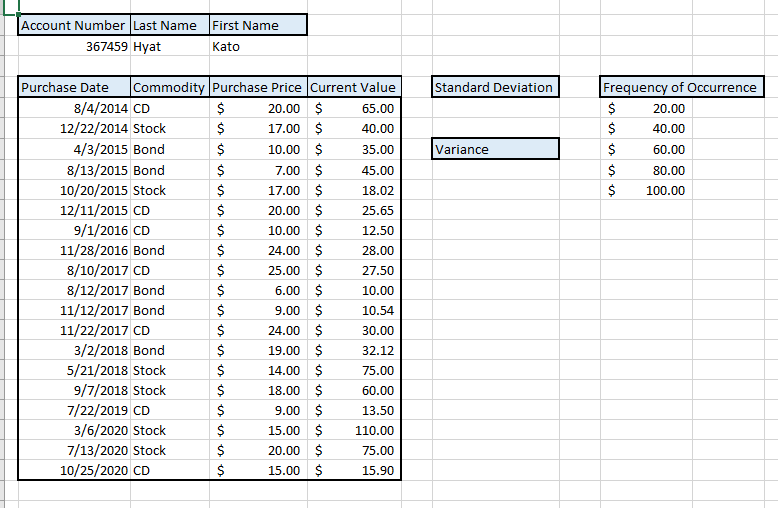

| 2 | Use the STDEV.S function to calculate the standard deviation between the current values of all commodities in cell G6. | 14 |

| 3 | Use the VAR.S function to calculate the variance between the current values of all commodities in cell G9. | 14 |

| 4 | Ensure the Analysis ToolPak is loaded. Create a descriptive statistics summary based on the current value of investments in column E. Display the output in cell G12. | 16 |

| 5 | Format the mean, median, mode, minimum, maximum, and sum in the report as Accounting Number Format. Resize the column as needed. | 10 |

| 6 | Use the FREQUENCY function to calculate the frequency distribution of commodity values based on the values located in the range I6:J10. | 14 |

| 7 | Click the Trend worksheet and use the CORREL function to calculate the correlation of purchase price and current value listed in the range C3:D10. | 14 |

| 8 | Create a Forecast Sheet displaying a forecast of purchase price through 1/1/2025. Name the worksheet Forecast_2025. Mac users, insert a new sheet named Forecast_2025. Copy the range B2:C9 on the Trend worksheet and paste it into cell A1 on the Forecast_2025 sheet. Type Forecast(Purchase Price) in cell C1 and 1/1/2025 in cell A9. In cell C9, enter the formula =FORECAST.ETS(A9,B2:B8,A2:A8). | 18 |

Account Number Last Name First Name 367459 Hyat Kato Standard Deviation Frequency of Occurrence $ 20.00 $ 40.00 $ 60.00 $ 80.00 $ 100.00 Variance Purchase Date Commodity Purchase Price Current Value 8/4/2014 CD $ 20.00 $ 65.00 12/22/2014 Stock $ 17.00 $ 40.00 4/3/2015 Bond $ 10.00 $ 35.00 8/13/2015 Bond $ 7.00 $ 45.00 10/20/2015 Stock $ 17.00 $ 18.02 12/11/2015 CD $ 20.00 $ 25.65 9/1/2016 CD $ 10.00 $ 12.50 11/28/2016 Bond $ 24.00 $ 28.00 8/10/2017 CD $ 25.00 $ 27.50 8/12/2017 Bond $ 6.00 $ 10.00 11/12/2017 Bond $ 9.00 $ 10.54 11/22/2017 CD $ 24.00 $ 30.00 3/2/2018 Bond $ 19.00 $ 32.12 5/21/2018 Stock $ 14.00 $ 75.00 9/7/2018 Stock $ 18.00 $ 60.00 7/22/2019 CD $ 9.00 $ 13.50 3/6/2020 Stock $ 15.00 $ 110.00 7/13/2020 Stock $ 20.00 $ 75.00 10/25/2020 CD $ 15.00 $ 15.90 Account Number Last Name First Name 367459 Hyat Kato Standard Deviation Frequency of Occurrence $ 20.00 $ 40.00 $ 60.00 $ 80.00 $ 100.00 Variance Purchase Date Commodity Purchase Price Current Value 8/4/2014 CD $ 20.00 $ 65.00 12/22/2014 Stock $ 17.00 $ 40.00 4/3/2015 Bond $ 10.00 $ 35.00 8/13/2015 Bond $ 7.00 $ 45.00 10/20/2015 Stock $ 17.00 $ 18.02 12/11/2015 CD $ 20.00 $ 25.65 9/1/2016 CD $ 10.00 $ 12.50 11/28/2016 Bond $ 24.00 $ 28.00 8/10/2017 CD $ 25.00 $ 27.50 8/12/2017 Bond $ 6.00 $ 10.00 11/12/2017 Bond $ 9.00 $ 10.54 11/22/2017 CD $ 24.00 $ 30.00 3/2/2018 Bond $ 19.00 $ 32.12 5/21/2018 Stock $ 14.00 $ 75.00 9/7/2018 Stock $ 18.00 $ 60.00 7/22/2019 CD $ 9.00 $ 13.50 3/6/2020 Stock $ 15.00 $ 110.00 7/13/2020 Stock $ 20.00 $ 75.00 10/25/2020 CD $ 15.00 $ 15.90

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts