Question: Please note that all final answers have been rounded to the nearest $10. If a problem requires multiple computations, round nothing until attaining the final

Please note that all final answers have been rounded to the nearest $10. If a problem requires multiple computations, round nothing until attaining the final answer and then round it to the nearest $10.

Please note that all final answers have been rounded to the nearest $10. If a problem requires multiple computations, round nothing until attaining the final answer and then round it to the nearest $10.

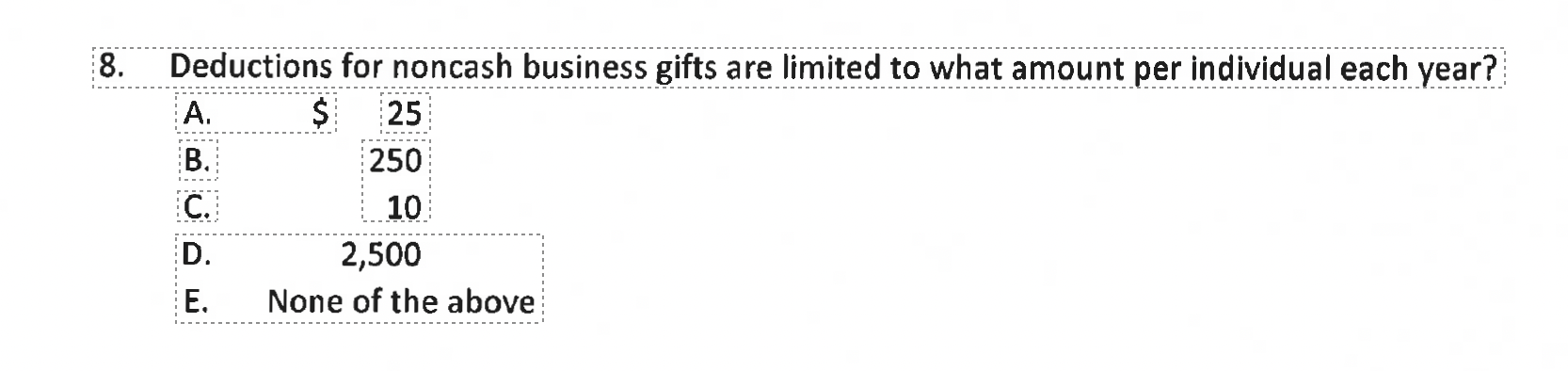

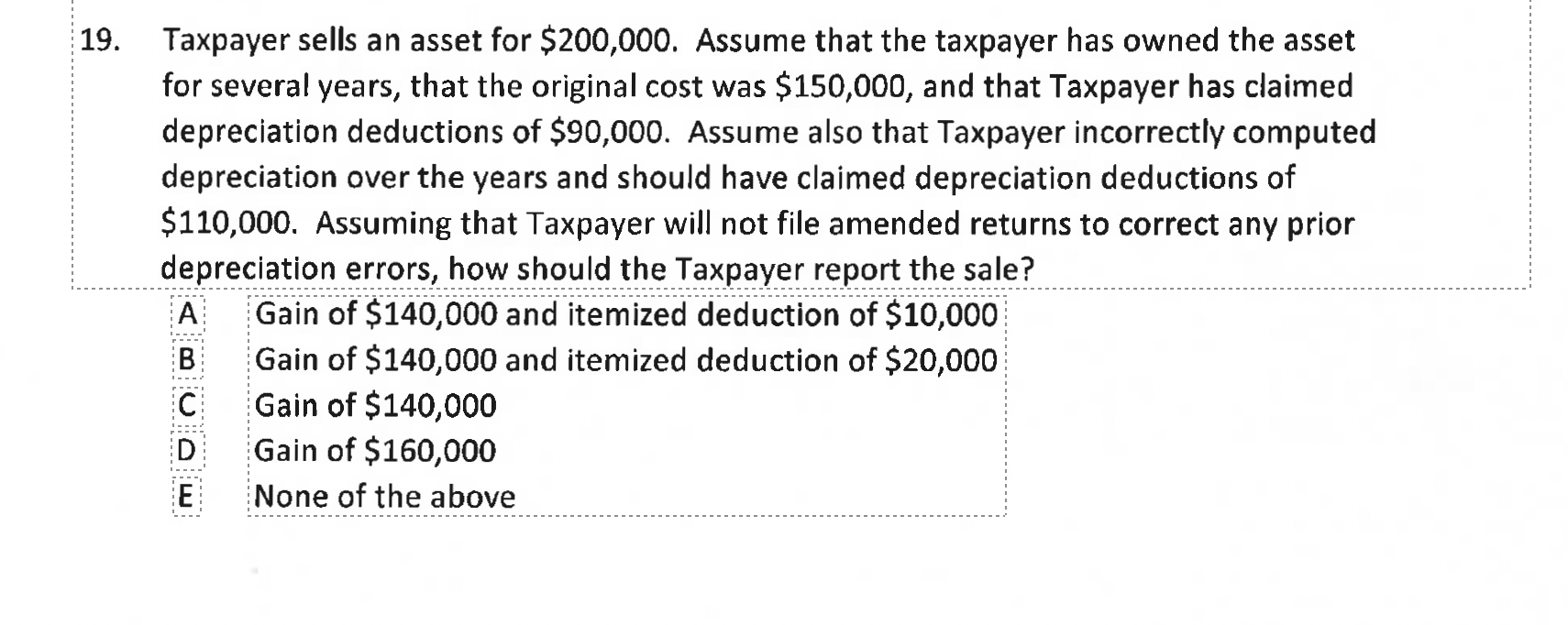

8. Deductions for noncash business gifts are limited to what amount per individual each year? 19. Taxpayer sells an asset for $200,000. Assume that the taxpayer has owned the asset for several years, that the original cost was $150,000, and that Taxpayer has claimed depreciation deductions of $90,000. Assume also that Taxpayer incorrectly computed depreciation over the years and should have claimed depreciation deductions of $110,000. Assuming that Taxpayer will not file amended returns to correct any prior depreciation errors, how should the Taxpayer report the sale

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts