Question: Please note that all final answers have been rounded to the nearest $10. If a problem requires multiple computations, round nothing until attaining the final

Please note that all final answers have been rounded to the nearest $10. If a problem requires multiple computations, round nothing until attaining the final answer and then round it to the nearest $10.

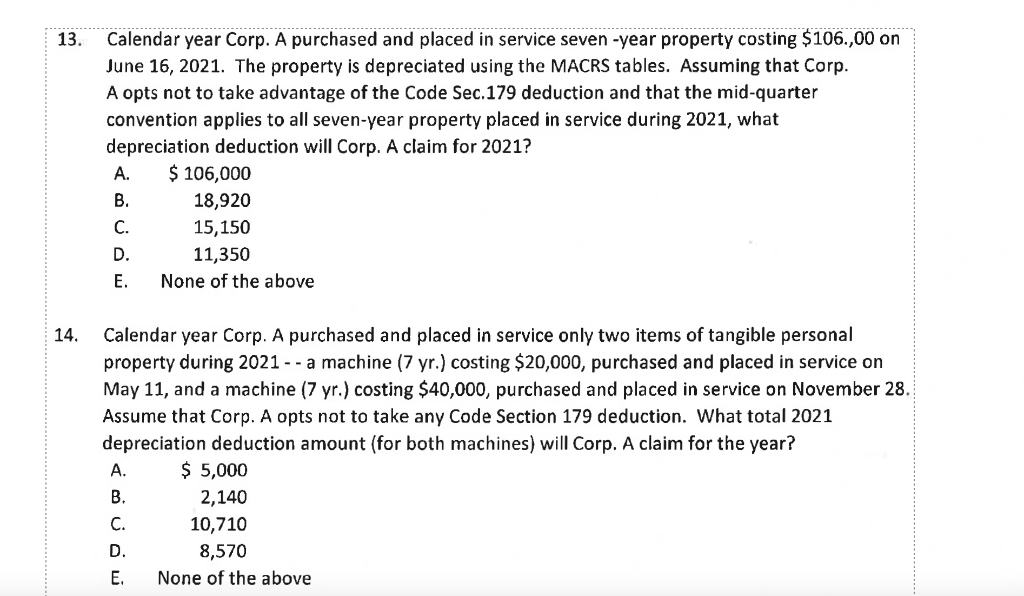

13. Calendar year Corp. A purchased and placed in service seven -year property costing $106.,00 on June 16,2021 . The property is depreciated using the MACRS tables. Assuming that Corp. A opts not to take advantage of the Code Sec. 179 deduction and that the mid-quarter convention applies to all seven-year property placed in service during 2021, what depreciation deduction will Corp. A claim for 2021? A. $106,000 B. 18,920 C. 15,150 D. 11,350 E. None of the above 4. Calendar year Corp. A purchased and placed in service only two items of tangible personal property during 2021 - - a machine ( 7 yr.) costing $20,000, purchased and placed in service on May 11 , and a machine ( 7 yr.) costing $40,000, purchased and placed in service on November 28. Assume that Corp. A opts not to take any Code Section 179 deduction. What total 2021 depreciation deduction amount (for both machines) will Corp. A claim for the year? A. $5,000 B. 2,140 C. 10,710 D. 8,570 E. None of the above 13. Calendar year Corp. A purchased and placed in service seven -year property costing $106.,00 on June 16,2021 . The property is depreciated using the MACRS tables. Assuming that Corp. A opts not to take advantage of the Code Sec. 179 deduction and that the mid-quarter convention applies to all seven-year property placed in service during 2021, what depreciation deduction will Corp. A claim for 2021? A. $106,000 B. 18,920 C. 15,150 D. 11,350 E. None of the above 4. Calendar year Corp. A purchased and placed in service only two items of tangible personal property during 2021 - - a machine ( 7 yr.) costing $20,000, purchased and placed in service on May 11 , and a machine ( 7 yr.) costing $40,000, purchased and placed in service on November 28. Assume that Corp. A opts not to take any Code Section 179 deduction. What total 2021 depreciation deduction amount (for both machines) will Corp. A claim for the year? A. $5,000 B. 2,140 C. 10,710 D. 8,570 E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts