Question: Please note that all final answers have been rounded to the nearest $10. If a problem requires multiple computations, round nothing until attaining the final

Please note that all final answers have been rounded to the nearest $10. If a problem requires multiple computations, round nothing until attaining the final answer and then round it to the nearest $10.

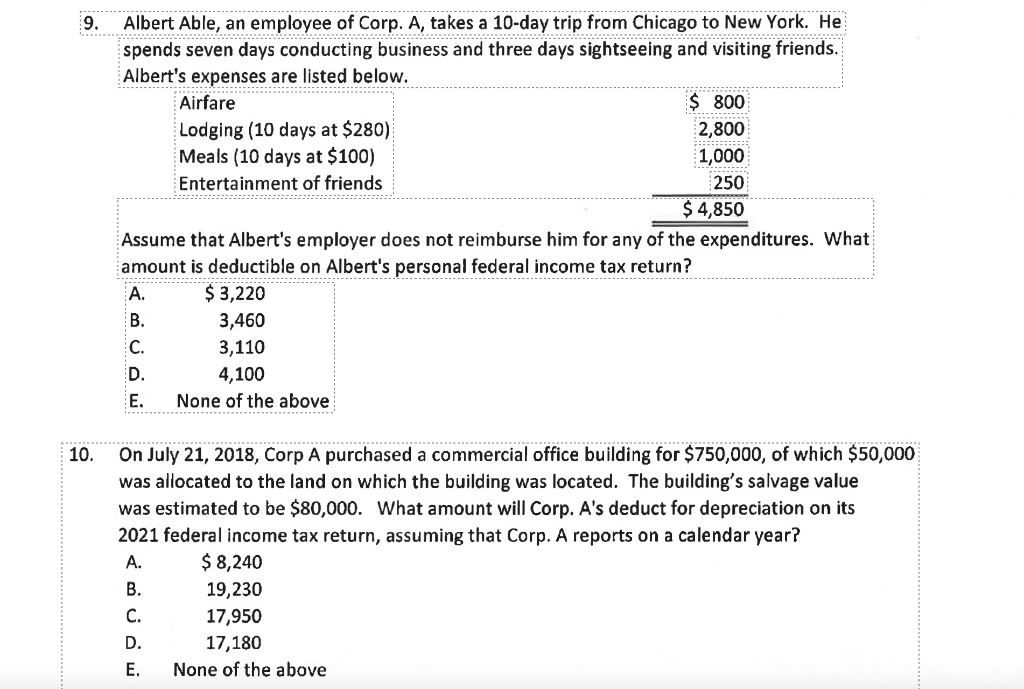

9. Albert Able, an employee of Corp. A, takes a 10-day trip from Chicago to New York. He spends seven days conducting business and three days sightseeing and visiting friends. Albert's exbenses are listed below. Assume that Albert's employer does not reimburse him for any of the expenditures. What amount is deductible on Albert's personal federal income tax return? On July 21,2018 , Corp A purchased a commercial office building for $750,000, of which $50,000 was allocated to the land on which the building was located. The building's salvage value was estimated to be $80,000. What amount will Corp. A's deduct for depreciation on its 2021 federal income tax return, assuming that Corp. A reports on a calendar year? A. $8,240 B. 19,230 C. 17,950 D. 17,180 E. None of the above 9. Albert Able, an employee of Corp. A, takes a 10-day trip from Chicago to New York. He spends seven days conducting business and three days sightseeing and visiting friends. Albert's exbenses are listed below. Assume that Albert's employer does not reimburse him for any of the expenditures. What amount is deductible on Albert's personal federal income tax return? On July 21,2018 , Corp A purchased a commercial office building for $750,000, of which $50,000 was allocated to the land on which the building was located. The building's salvage value was estimated to be $80,000. What amount will Corp. A's deduct for depreciation on its 2021 federal income tax return, assuming that Corp. A reports on a calendar year? A. $8,240 B. 19,230 C. 17,950 D. 17,180 E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts