Question: Please only answer if you know the answer 100%. Answer all or I will down vote. 2 pts Question 11 Judy has a $100,000 life

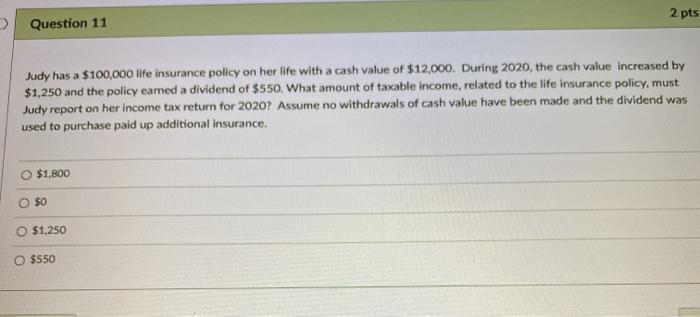

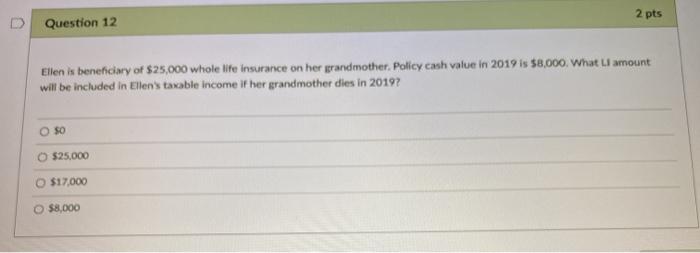

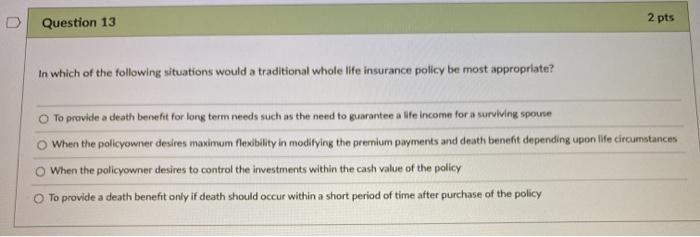

2 pts Question 11 Judy has a $100,000 life insurance policy on her life with a cash value of $12,000. During 2020, the cash value increased by $1,250 and the policy earned a dividend of $550, What amount of taxable income, related to the life insurance policy, must Judy report on her income tax return for 2020? Assume no withdrawals of cash value have been made and the dividend was used to purchase paid up additional insurance. $1,800 $0 $1,250 O $550 2 pts Question 12 Ellen is beneficiary of $25,000 whole life insurance on her grandmother. Policy cash value in 2019 is $8,000. What amount will be included in Ellen's taxable income if her grandmother dies in 2019? OSO O $25.000 O $17.000 O $8,000 D Question 13 2 pts in which of the following situations would a traditional whole life insurance policy be most appropriate? To provide a death benefit for long term needs such as the need to guarantee a life income for a surviving spouse When the policyowner desires maximum flexibility in modifying the premium payments and death benefit depending upon life circumstances When the policyowner desires to control the investments within the cash value of the policy To provide a death benefit only if death should occur within a short period of time after purchase of the policy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts