Question: please please help I will rate definately. All questions pls. 26. Which of the following is true regarding TFSA's? a) Contributions are limited to an

please please help I will rate definately. All questions pls.

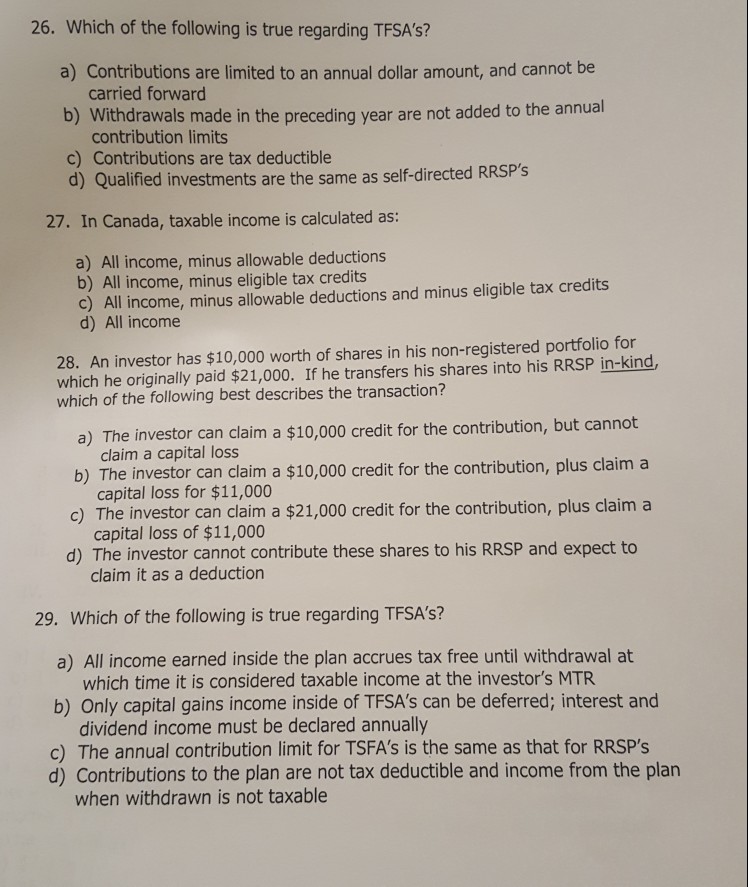

26. Which of the following is true regarding TFSA's? a) Contributions are limited to an annual dollar amount, and cannot be carried forward b) Withdrawals made in the preceding year are not added to the annual contribution limits c) Contributions are tax deductible are the same as self-directed RRSP's 27. In Canada, taxable income is calculated as: a) All income, minus allowable deductions b) All income, minus eligible tax credits c) All income, minus allowable deductions and minus eligible tax credits d) All income 28. An investor has $10,000 worth of shares in his non-registered portfolio for which he originally paid $21,000. If he transfers his shares into his RRSP in-kind, which of the following best describes the transaction? a) The investor can claim a $10,000 credit for the contribution, but cannot b) The investor can claim a $10,000 credit for the contribution, plus claim a c) The investor can claim a $21,000 credit for the contribution, plus claim a d) The investor cannot contribute these shares to his RRSP and expect to claim a capital loss capital loss for $11,000 capital loss of $11,000 claim it as a deduction 29. Which of the following is true regarding TFSA's? a) All income earned inside the plan accrues tax free until withdrawal at which time it is considered taxable income at the investor's MTR b) Only capital gains income inside of TFSA's can be deferred; interest and dividend income must be declared annually c) The annual contribution limit for TSFA's is the same as that for RRSP'S d) Contributions to the plan are not tax deductible and income from the plan when withdrawn is not taxable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts