Question: Please show all equations and work as necessary. I. You would like to invest in Ford and Apple stock. Ford has an expected return of

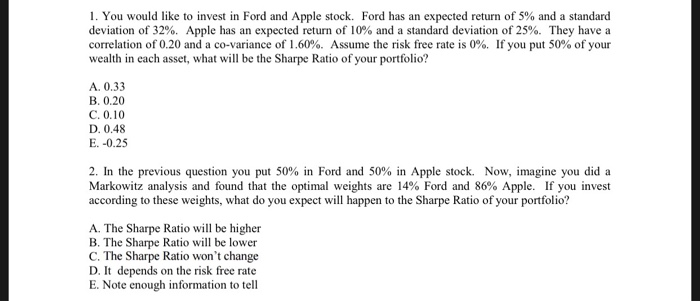

I. You would like to invest in Ford and Apple stock. Ford has an expected return of 5% and a standard deviation of 32%. Apple has an expected return of 10% and a standard deviation of 25%. They have a correlation of 0.20 and a co-variance of 1.60%. Assume the risk free rate is 0%. If you put 50% of your wealth in each asset, what will be the Sharpe Ratio of your portfolio? A. 0.33 B. 0.20 C. 0.10 D. 0.48 E. -0.25 2. In the previous question you put 50% in Ford and 50% in Apple stock. Now, imagine you did a Markowitz analysis and found that the optimal weights are 14% Ford and 86% Apple. If you invest according to these weights, what do you expect will happen to the Sharpe Ratio of your portfolio? A. The Sharpe Ratio will be higher B. The Sharpe Ratio will be lower C. The Sharpe Ratio won't change D. It depends on the risk free rate E. Note enough information to tell

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts