Question: please solve : - please use the same format when solving the problem. - show on excel - show work - show formulas -explain Thank

please solve :

- please use the same format when solving the problem.

- show on excel

- show work

- show formulas

-explain

Thank you!

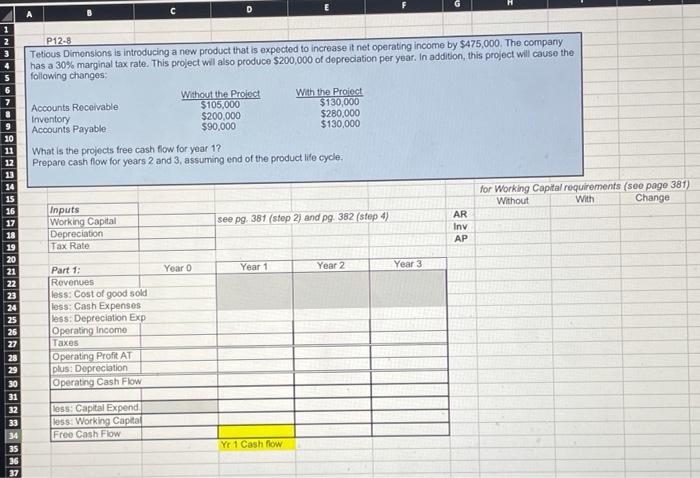

1 2 P12-8 Tetious Dimensions is introducing a new product that is expected to increase it net operating income by $475,000. The company has a 30% marginal tax rate. This project will also produce $200,000 of depreciation per year. In addition, this project will cause the following changes Without the Project With the Proiect Accounts Receivable $105,000 $130,000 Inventory $200,000 $280,000 Accounts Payable $90,000 $130,000 10 What is the projects free cash flow for year 1? Prepare cash flow for years 2 and 3, assuming end of the product life cycle. for Working Capital requirements (see page 381) Without With Change 16 see pg. 381 (step 2) and pg 382 (step 4) Inputs Working Capital Depreciation Tax Rate AR Inv AP 18 19 20 Year o Year 1 Year 2 Year 3 HASARARENNAARRERA 23 24 25 26 27 28 29 30 31 32 Part 1: Revenues less: Cost of good sold less: Cash Expenses less: Depreciation Exp Operating Incomo Taxes Operating Profit AT plus: Depreciation Operating Cash Flow less: Capital Expend less: Working Capital Free Cash Flow 34 35 36 Ye 1 Cash flow 37

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts