Question: Please solve the whole question and explain the method completely Can you explain how to solve the five demands, and explain the method of calculation?

Please solve the whole question and explain the method completely Can you explain how to solve the five demands, and explain the method of calculation?

thank you

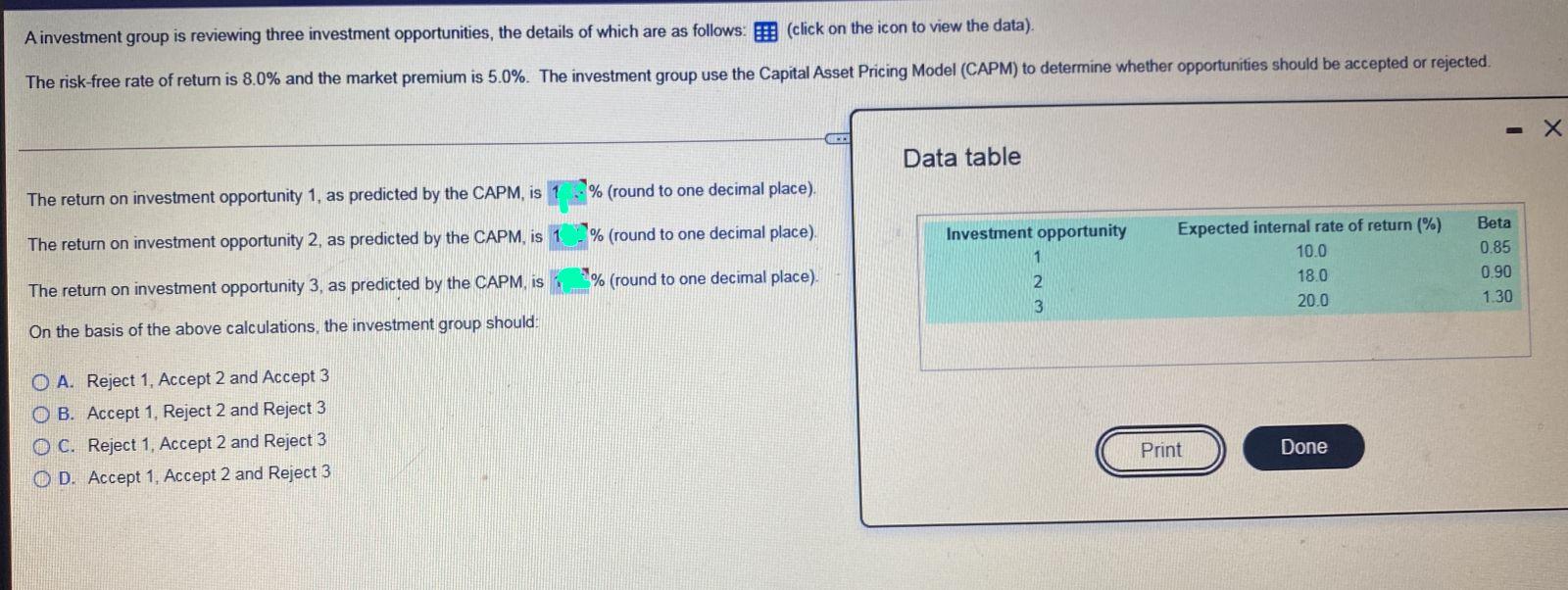

A investment group is reviewing three investment opportunities, the details of which are as follows: (click on the icon to view the data). The risk-free rate of return is 8.0% and the market premium is 5.0%. The investment group use the Capital Asset Pricing Model (CAPM) to determine whether opportunities should be accepted or rejected. Data table The return on investment opportunity 1, as predicted by the CAPM, is 1 % (round to one decimal place). The return on investment opportunity 2, as predicted by the CAPM, is 1% (round to one decimal place). % (round to one decimal place). Investment opportunity Expected internal rate of return (%) Beta 1 10.0 0.85 2 18.0 0.90 20.0 1.30 The return on investment opportunity 3, as predicted by the CAPM, is On the basis of the above calculations, the investment group should: OA. Reject 1, Accept 2 and Accept 3 OB. Accept 1, Reject 2 and Reject 3 OC. Reject 1, Accept 2 and Reject 3 OD. Accept 1, Accept 2 and Reject 3 Print Done -X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts