Question: Please solve the whole question and explain the method completely Can you explain how to solve the five demands, and explain the method of calculation?

Please solve the whole question and explain the method completely Can you explain how to solve the five demands, and explain the method of calculation?

thank you

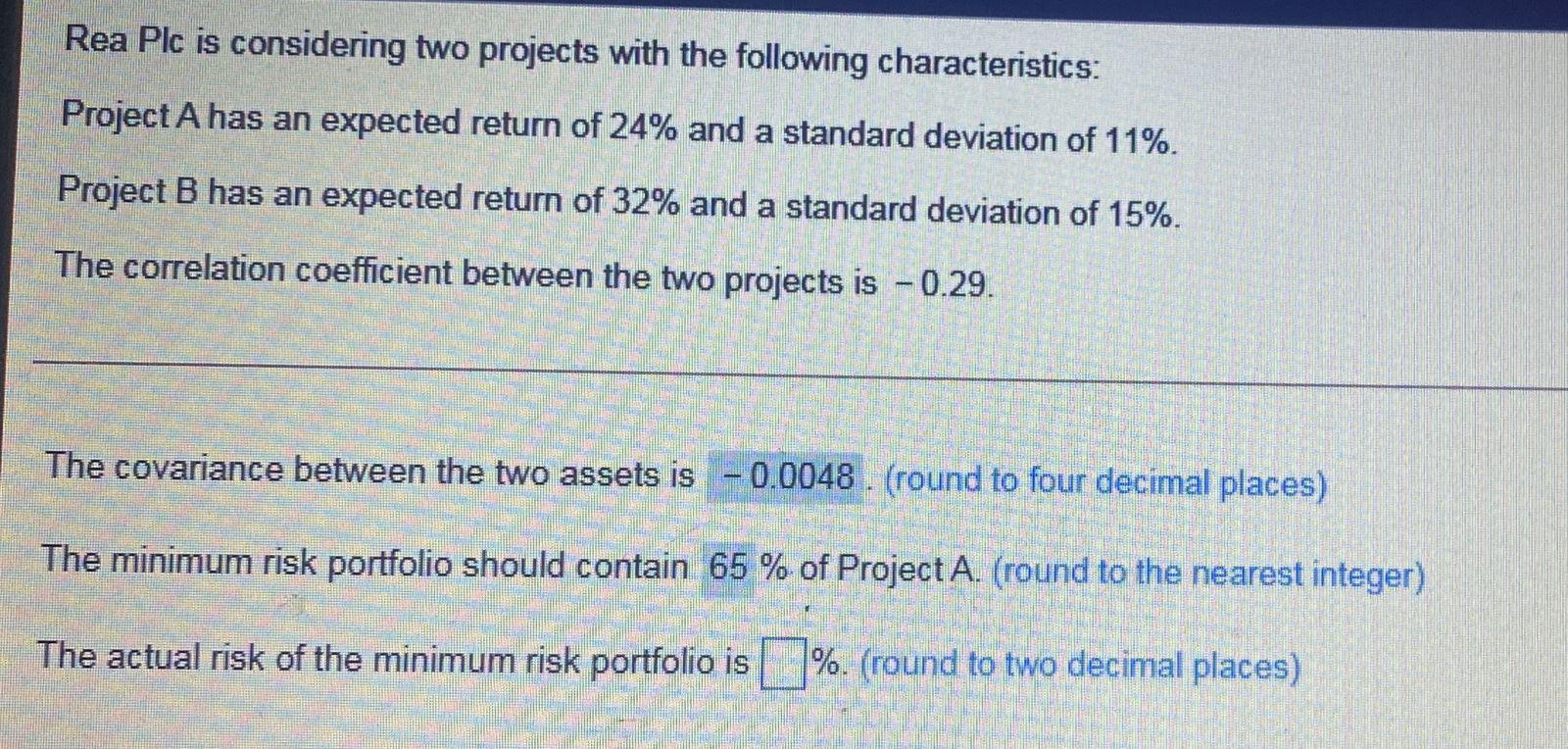

Rea Plc is considering two projects with the following characteristics: Project A has an expected return of 24% and a standard deviation of 11%. a Project B has an expected return of 32% and a standard deviation of 15%. The correlation coefficient between the two projects is - 0.29. The covariance between the two assets is - 0.0048 . (round to four decimal places) The minimum risk portfolio should contain 65 % of Project A. (round to the nearest integer) The actual risk of the minimum risk portfolio is %. (round to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts