Question: Please solve the whole question and explain the method completely Can you explain how to solve the five demands, and explain the method of calculation?

Please solve the whole question and explain the method completely Can you explain how to solve the five demands, and explain the method of calculation?

thank you

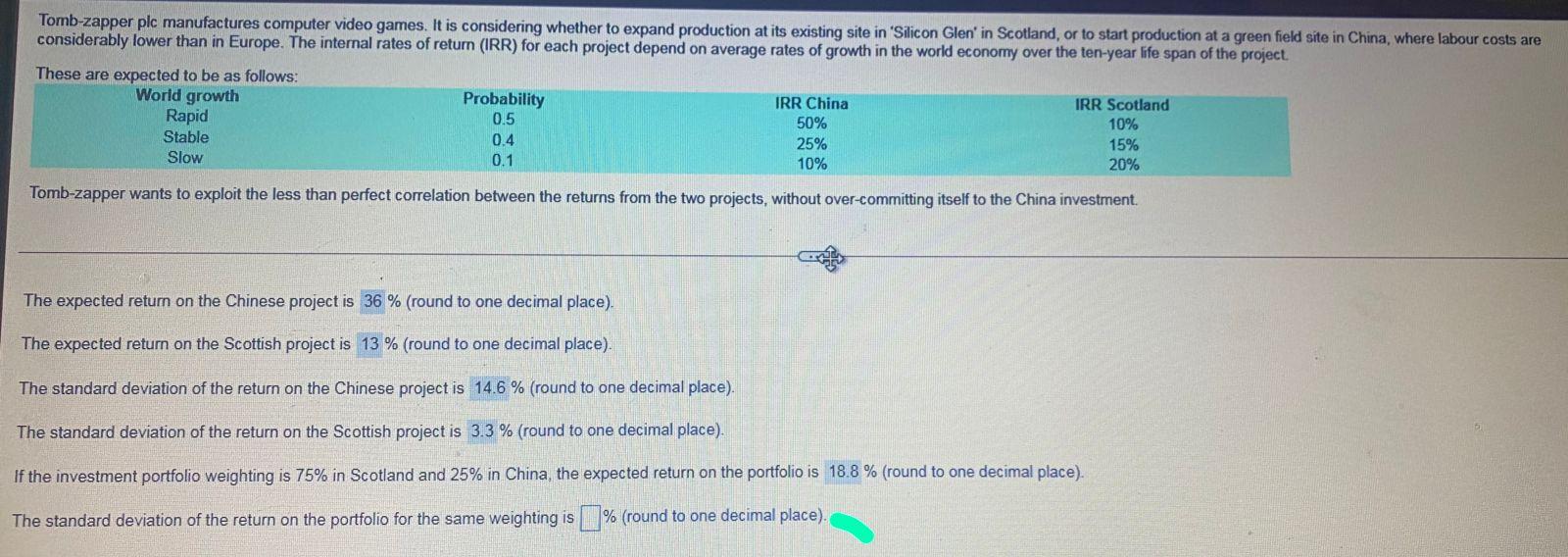

Tomb-zapper plc manufactures computer video games. It is considering whether to expand production at its existing site in "Silicon Glen' in Scotland, or to start production at a green field site in China, where labour costs are considerably lower than in Europe. The internal rates of return (IRR) for each project depend on average rates of growth in the world economy over the ten-year life span of the project These are expected to be as follows: World growth Probability IRR China IRR Scotland Rapid 0.5 50% 10% Stable 0.4 25% 15% Slow 0.1 10% 20% Tomb-zapper wants to exploit the less than perfect correlation between the returns from the two projects, without over-committing itself to the China investment. The expected return on the Chinese project is 36 % (round to one decimal place). The expected return on the Scottish project is 13 % (round to one decimal place). The standard deviation of the return on the Chinese project is 14.6 % (round to one decimal place). The standard deviation of the return on the Scottish project is 3.3 % (round to one decimal place). If the investment portfolio weighting is 75% in Scotland and 25% in China, the expected return on the portfolio is 18.8 % (round to one decimal place). The standard deviation of the return on the portfolio for the same weighting is [% (round to one decimal place)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts