Question: Problem 2.1. (a) What is the Black-Scholes partial differential equation (PDE) for the price f(t, St) at time t of a European derivative security on

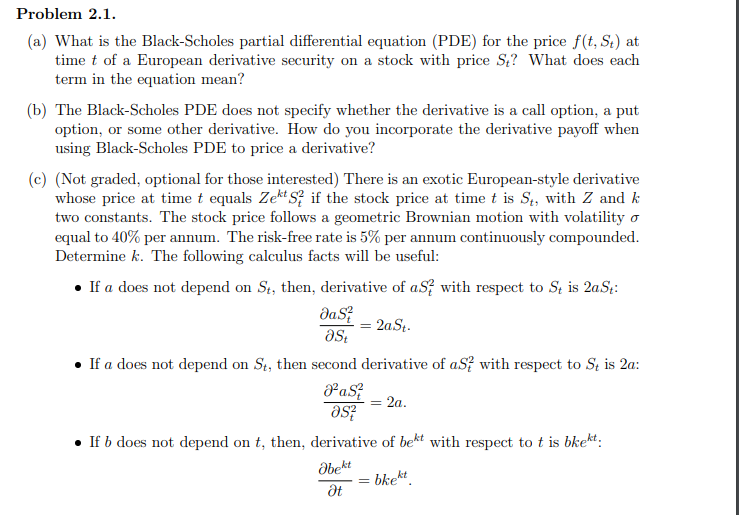

Problem 2.1. (a) What is the Black-Scholes partial differential equation (PDE) for the price f(t, St) at time t of a European derivative security on a stock with price St? What does each term in the equation mean? (b) The Black-Scholes PDE does not specify whether the derivative is a call option, a put option, or some other derivative. How do you incorporate the derivative payoff when using Black-Scholes PDE to price a derivative? (c) (Not graded, optional for those interested) There is an exotic European-style derivative whose price at time t equals Zekt Sif the stock price at time t is St, with Z and k two constants. The stock price follows a geometric Brownian motion with volatility o equal to 40% per annum. The risk-free rate is 5% per annum continuously compounded. Determine k. The following calculus facts will be useful: If a does not depend on St, then, derivative of as with respect to St is 2a.St: da S St = 2a St. If a does not depend on St, then second derivative of aS? with respect to St is 2a: Past S 2a. If b does not depend on t, then, derivative of bekt with respect to t is bkekt. bekt bkekt t Problem 2.1. (a) What is the Black-Scholes partial differential equation (PDE) for the price f(t, St) at time t of a European derivative security on a stock with price St? What does each term in the equation mean? (b) The Black-Scholes PDE does not specify whether the derivative is a call option, a put option, or some other derivative. How do you incorporate the derivative payoff when using Black-Scholes PDE to price a derivative? (c) (Not graded, optional for those interested) There is an exotic European-style derivative whose price at time t equals Zekt Sif the stock price at time t is St, with Z and k two constants. The stock price follows a geometric Brownian motion with volatility o equal to 40% per annum. The risk-free rate is 5% per annum continuously compounded. Determine k. The following calculus facts will be useful: If a does not depend on St, then, derivative of as with respect to St is 2a.St: da S St = 2a St. If a does not depend on St, then second derivative of aS? with respect to St is 2a: Past S 2a. If b does not depend on t, then, derivative of bekt with respect to t is bkekt. bekt bkekt t

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts