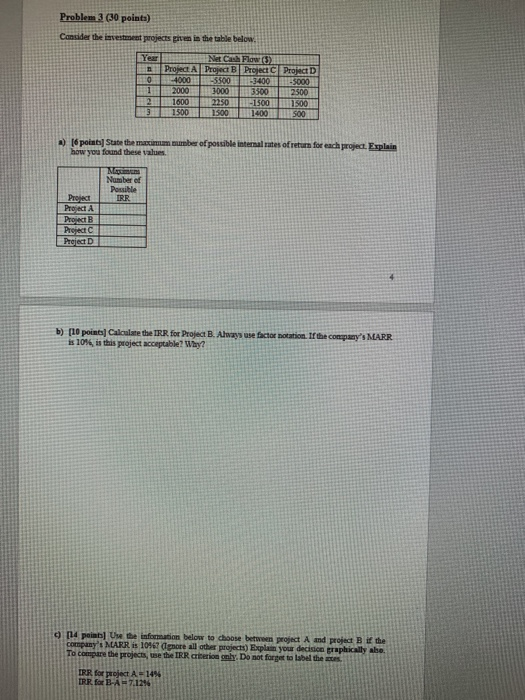

Question: Problem 3 (30 points) Consider the investment projects given in the table below. Year 0 Net Cal Flow (5) Project A Project Project Project D

Problem 3 (30 points) Consider the investment projects given in the table below. Year 0 Net Cal Flow (5) Project A Project Project Project D 4000 5500 -3400 -5000 2000 3000 3500 2500 1600 2250 -1500 1500 1500 1400 500 2 3 1500 a) (6 points State the maman sumber of possible internal rates of return for each project. Explain how you found these values Number of Possible IRR Project Project A Project B Project Project D 4 b) [10 points Calculate the IRR for Project B. Always use factor notation. If the company's MARR is 10%, is this project acceptable? Why? 9 114 points the information below to choose between project A and project the company': MARR is 10967 (gnore all other project) Explain your decision graphically abo. To compare the projects, the the IRR creation only. Do not forget to label the IRR for project A = 14% IRR for BA-7.1296

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts