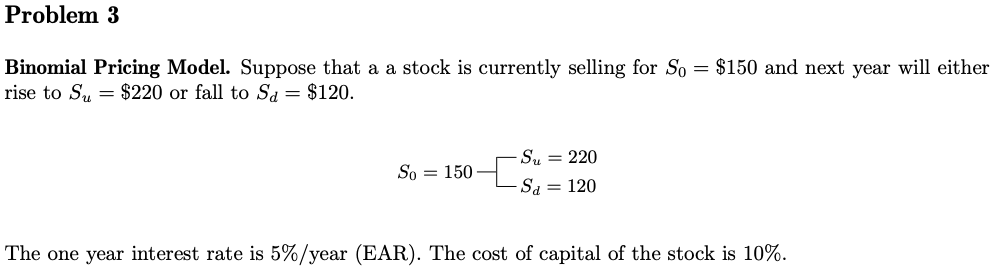

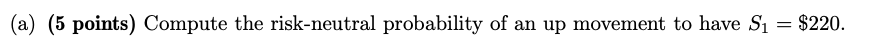

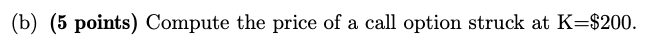

Question: Problem 3 Binomial Pricing ModeL Suppose that a a stock is currently selling for So 2 $150 and next year will either rise to S

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts