Question: Problem 3.2. (10 points) Assume CAPM. This is the current capital structure of a particular company: The company has one million shares outstanding with

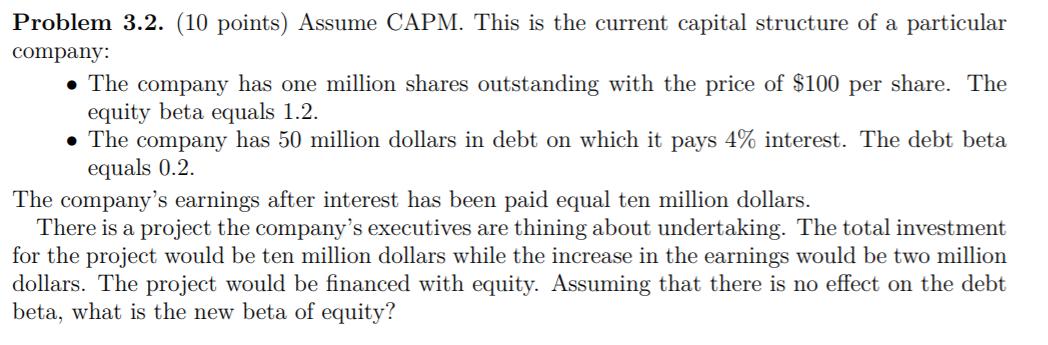

Problem 3.2. (10 points) Assume CAPM. This is the current capital structure of a particular company: The company has one million shares outstanding with the price of $100 per share. The equity beta equals 1.2. The company has 50 million dollars in debt on which it pays 4% interest. The debt beta equals 0.2. The company's earnings after interest has been paid equal ten million dollars. There is a project the company's executives are thining about undertaking. The total investment for the project would be ten million dollars while the increase in the earnings would be two million dollars. The project would be financed with equity. Assuming that there is no effect on the debt beta, what is the new beta of equity?

Step by Step Solution

There are 3 Steps involved in it

ANS WER The new beta of equity would be 1 4 WORK ING 1 2 10 million 1 milli... View full answer

Get step-by-step solutions from verified subject matter experts