Question: HiTech manufactures two products: Regular and Super. The results of operations for 20x1 follow. Fixed manufacturing costs included in cost of goods sold amount to

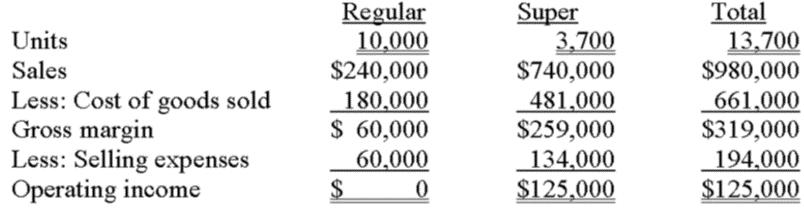

HiTech manufactures two products: Regular and Super. The results of operations for 20x1 follow.

Fixed manufacturing costs included in cost of goods sold amount to $30,000 for Regular and $74,000 for Super the remaining cost of goods sold is variable manufacturing costs. Variable selling expenses are $4 per unit for Regular and $20 per unit for Super; the remaining selling expenses are fixed cost.

Required:

1. If HiTech eliminates Regular and uses the available capacity to produce and sell an additional 1,500 units of Super, what would be the new operating income for the company? Prepare a new income statement below. Hint: Since the company is moving capacity over to Super the fixed costs incurred for the Regular product will shift to the Super product. Make sure you show your work.

Super | |

Units | |

Sales | |

Less: Cost of goods sold | |

Gross margin | |

Less: Selling Expense | |

Operating income |

2. Should the company eliminate the Regular product? Why?

Units Sales Less: Cost of goods sold Gross margin Less: Selling expenses Operating income Regular 10,000 $240,000 180,000 $ 60,000 60,000 $ Super 3,700 $740,000 481,000 $259,000 134,000 $125,000 Total 13.700 $980,000 661,000 $319,000 194,000 $125,000

Step by Step Solution

3.50 Rating (163 Votes )

There are 3 Steps involved in it

Particulars Unit Sales LessCost of goods sold Gross margin Less Selling expenses Oper... View full answer

Get step-by-step solutions from verified subject matter experts