Question: Problem1 Consider pricing put options on a stock.We use the binomial lattice technique to price options. The current price of the stock is $20. The

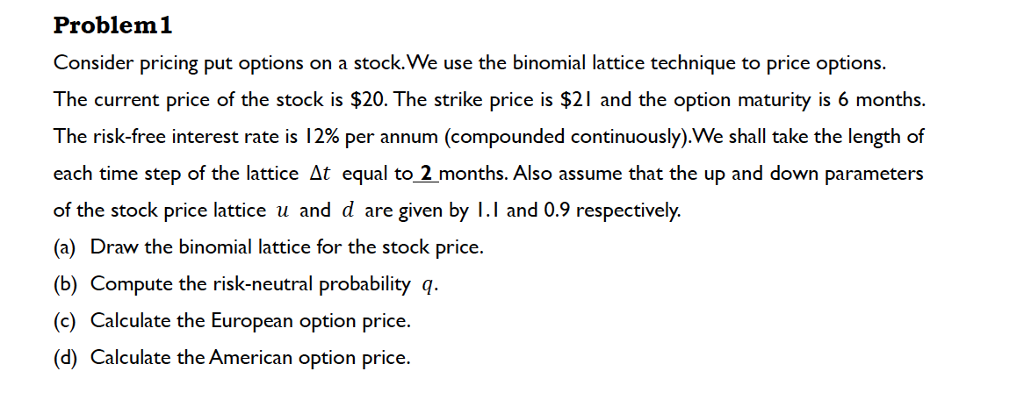

Problem1 Consider pricing put options on a stock.We use the binomial lattice technique to price options. The current price of the stock is $20. The strike price is $21 and the option maturity is 6 months. The risk-free interest rate is 12% per annum (compounded continuously)We shall take the length of each time step of the lattice ?t equal to!months. Also assume that the up and down parameters of the stock price lattice u and d are given by I.1 and 0.9 respectively (a) Draw the binomial lattice for the stock price. (b) Compute the risk-neutral probability q c) Calculate the European option price. (d) Calculate the American option price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts