Question: Project #4 - Bond Amortization The ECC District is preparing to sell bonds to improve their campus. The cost of the project is $900,000 and

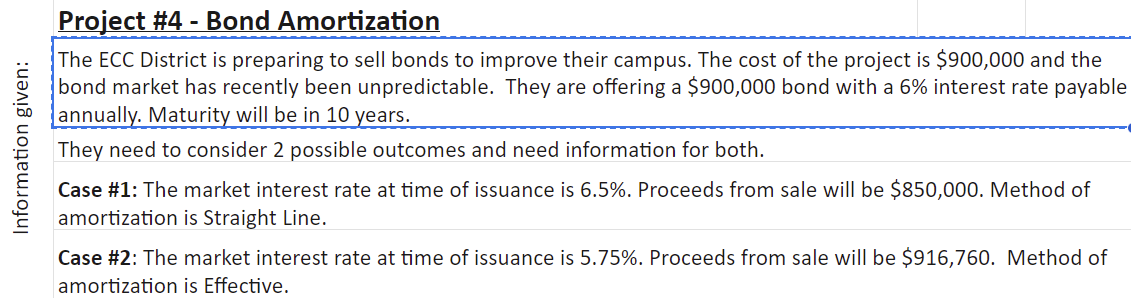

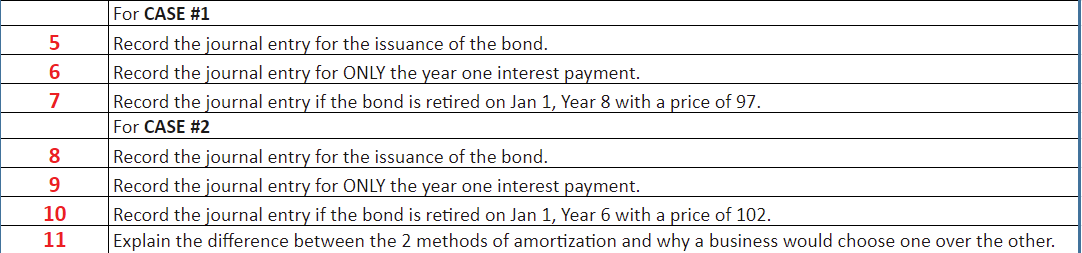

Project \#4 - Bond Amortization The ECC District is preparing to sell bonds to improve their campus. The cost of the project is $900,000 and the bond market has recently been unpredictable. They are offering a $900,000 bond with a 6% interest rate payable annually. Maturity will be in 10 years. They need to consider 2 possible outcomes and need information for both. Case \#1: The market interest rate at time of issuance is 6.5%. Proceeds from sale will be $850,000. Method of amortization is Straight Line. Case \#2: The market interest rate at time of issuance is 5.75%. Proceeds from sale will be $916,760. Method of amortization is Effective. \begin{tabular}{|c|l|} \hline & For CASE \#1 \\ \hline 5 & Record the journal entry for the issuance of the bond. \\ \hline 6 & Record the journal entry for ONLY the year one interest payment. \\ \hline 7 & Record the journal entry if the bond is retired on Jan 1, Year 8 with a price of 97. \\ \hline & For CASE \#2 \\ \hline 8 & Record the journal entry for the issuance of the bond. \\ \hline 9 & Record the journal entry for ONLY the year one interest payment. \\ \hline 10 & Record the journal entry if the bond is retired on Jan 1, Year 6 with a price of 102. \\ \hline 11 & Explain the difference between the 2 methods of amortization and why a business would choose one over the other. \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts