Question: Question 1 4 points Save Answer year You have been asked to complete a discounted cash flows, left incomplete by an analyst, who has projected

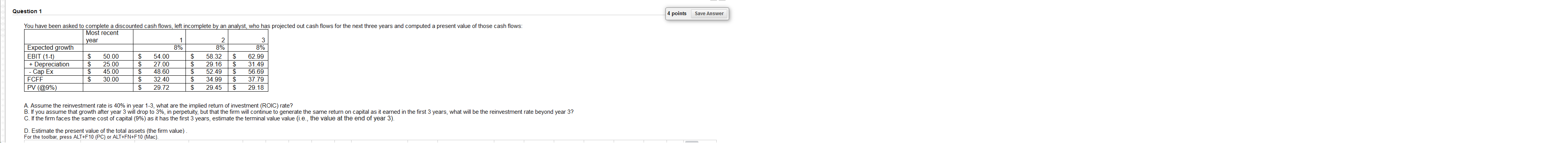

Question 1 4 points Save Answer year You have been asked to complete a discounted cash flows, left incomplete by an analyst, who has projected out cash flows for the next three years and computed a present value of those cash flows: Most recent 1 2 3 Expected growth 8% 8% 8% EBIT (1-1) $ 50.00 $ 54.00 $ 58.32 $ 62.99 + Depreciation $ 25.00 $ 27.00 $ 29.16 $ 31.49 Cap Ex $ 45.00 $ 48.60 $ 52.49 $ 56.69 FCFF $ 30.00 $ 32.40 $ 34.99 $ 37.79 PV (@9%) $ 29.72 $ 29.45 $ 29.18 A. Assume the reinvestment rate is 40% in year 1-3, what are the implied return of investment (ROIC) rate? B. If you assume that growth after year 3 will drop to 3%, in perpetuity, but that the firm will continue to generate the same return on capital as it earned in the first 3 years, what will be the reinvestment rate beyond year 3? C. If the firm faces the same cost of capital (9%) as it has the first 3 years, estimate the terminal value value (i.e., the value at the end of year 3). D. Estimate the present value of the total assets (the firm value) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). Question 1 4 points Save Answer year You have been asked to complete a discounted cash flows, left incomplete by an analyst, who has projected out cash flows for the next three years and computed a present value of those cash flows: Most recent 1 2 3 Expected growth 8% 8% 8% EBIT (1-1) $ 50.00 $ 54.00 $ 58.32 $ 62.99 + Depreciation $ 25.00 $ 27.00 $ 29.16 $ 31.49 Cap Ex $ 45.00 $ 48.60 $ 52.49 $ 56.69 FCFF $ 30.00 $ 32.40 $ 34.99 $ 37.79 PV (@9%) $ 29.72 $ 29.45 $ 29.18 A. Assume the reinvestment rate is 40% in year 1-3, what are the implied return of investment (ROIC) rate? B. If you assume that growth after year 3 will drop to 3%, in perpetuity, but that the firm will continue to generate the same return on capital as it earned in the first 3 years, what will be the reinvestment rate beyond year 3? C. If the firm faces the same cost of capital (9%) as it has the first 3 years, estimate the terminal value value (i.e., the value at the end of year 3). D. Estimate the present value of the total assets (the firm value) For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts