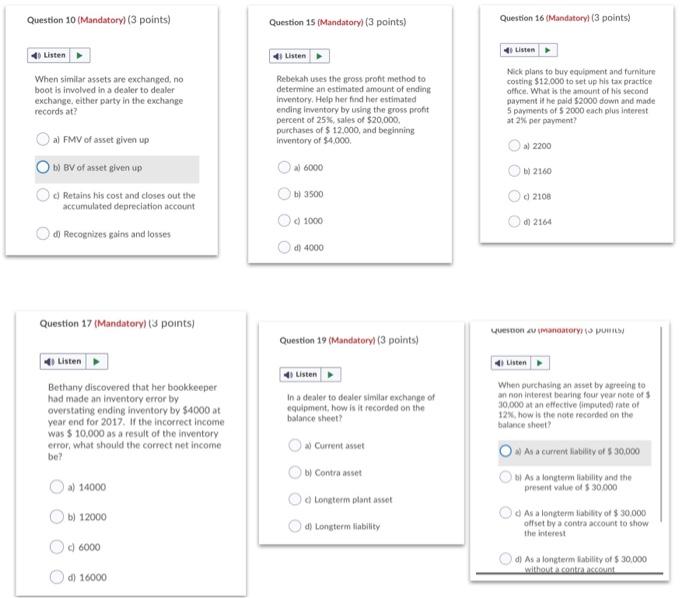

Question: Question 10 (Mandatory) (3 points) Question 15 (Mandatory (3 points) Question 16 (Mandatoryi (3 points) Listen Listen Listen When similar assets are exchanged, no boot

Question 10 (Mandatory) (3 points) Question 15 (Mandatory (3 points) Question 16 (Mandatoryi (3 points) Listen Listen Listen When similar assets are exchanged, no boot is involved in a dealer to dealer exchange, either party in the exchange records at? Rebekah uses the gross proht method to determine an estimated amount of ending inventory. Help her find her estimated ending Inventory by using the gross profit percent of 25%, sales of $20,000, purchases of $ 12,000, and beginning Inventory of $4.000 Nick plans to buy equipment and furniture costing $12,000 to set up his tax practice office. What is the amount of his second payment if he paid $2000 down and made 5 payments of $ 2000 each plus interest at 2% per payment? a) FMV of asset siven up bi BV of asset given up 6000 al 2200 W 2160 Retains his cost and closes out the accumulated depreciation account 613500 2108 001000 02164 Od Recognizes gains and tosses d) 4000 Question 17 Mandatory) (3 points) question 2 Mancators pour Question 19 (Mandatory! (3 points) Usten Listen Listen Bethany discovered that her bookkeeper had made an inventory error by overstating ending inventory by $4000 at year end for 2017. If the incorrect income was $ 10.000 as a result of the inventory error, what should the correct net income be? In a dealer to dealer similar exchange of equipment, how is it recorded on the balance sheet? When purchasing an asset by agreeing to an non interest bearing four year note of $ 30,000 at an effective imputed) rate of 12%, how is the note recorded on the balance sheet As a current Mobility of $30,000 Current asset b) Contrast Longterm plant asset d) Longterm liability As a longterm liability and the present value of $ 30.000 a) 14000 b) 12000 As a longterm Hability of $ 30.000 offset by a contra account to show the interest d 6000 d) As a longterm ability of $ 30.000 without contact d) 16000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts