Question: Question 15 a and b A statistical program is recommended. You may need to use this table to answer this question. The followl I prices

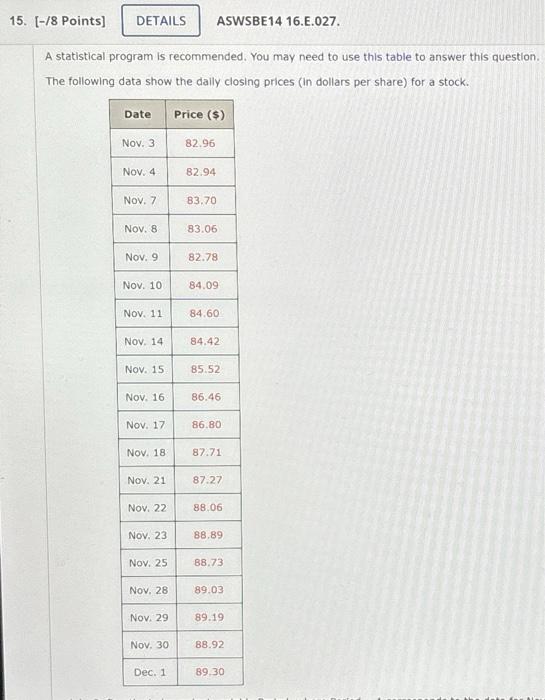

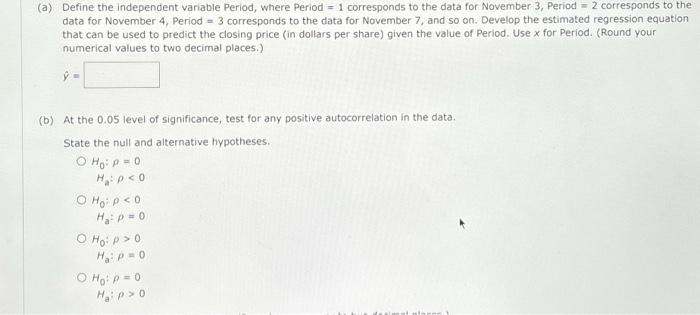

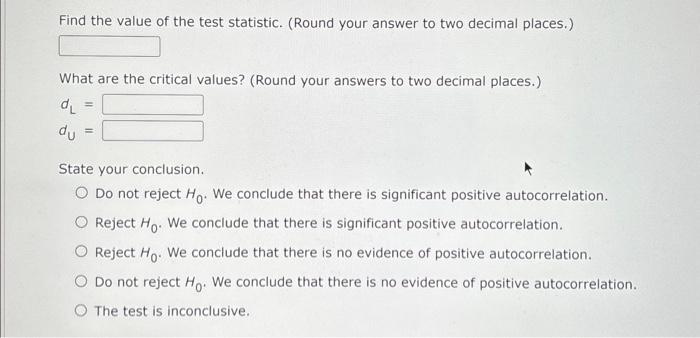

A statistical program is recommended. You may need to use this table to answer this question. The followl I prices (in dollars per share) for a stock. (a) Define the independent variable Period, where Period =1 corresponds to the data for November 3 , Period =2 corresponds to the data for November 4 , Period =3 corresponds to the data for November 7 , and so on. Develop the estimated regression equation that can be used to predict the closing price (in dollars per share) given the value of Period. Use x for Period. (Round your numerical values to two decimal places.) y^= (b) At the 0.05 level of significance, test for any positive autocorrelation in the data. State the null and alternative hypotheses. H0:=0Ha:0Ha:=0H0:=0Ha:>0 Find the value of the test statistic. (Round your answer to two decimal places.) What are the critical values? (Round your answers to two decimal places.) dL=dU= State your conclusion. Do not reject H0. We conclude that there is significant positive autocorrelation. Reject H0. We conclude that there is significant positive autocorrelation. Reject H0. We conclude that there is no evidence of positive autocorrelation. Do not reject H0. We conclude that there is no evidence of positive autocorrelation. The test is inconclusive

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts