Question: Question #5 of.70 Return on assets multiplier? Return on equity? Ne 2. Equity Multi Using the DuPont Identity Y3K, Inc.. has and a debt-equity ratio

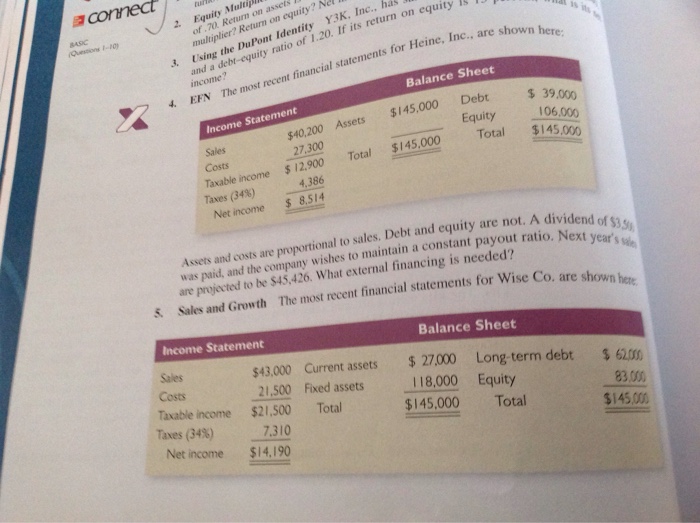

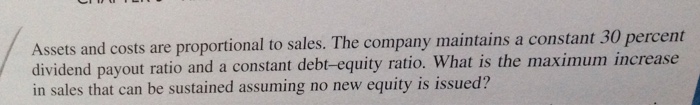

of.70 Return on assets multiplier? Return on equity? Ne 2. Equity Multi Using the DuPont Identity Y3K, Inc.. has and a debt-equity ratio of 1.20. If its return on equity income? is 3. are shown here 4. EFN The most recent financial statements for Heine, Inc. Balance Sheet Income Statement Sales Costs Taxable income Taxes G Debt $ 39000 $40,200 Assets $145,000 Debt Equity 27.300 Total $145.000 Total Total $145,000 $ 12.900 4,386 axes (34%) Net income $8,514 rtional to sales. Debt and equity are not. A dividend of s the company wishes to maintain a constant payout ratio. Next year Assets and costs are sales. dend of $3 are projected to be $45,426. What external financing is needed? s Sales and Growth The most recent financial statements for Wise Co. are shown Income Statement Sales Costs Balance Sheet $43.000 Current assets 27000 Long.term debt $62 21,500 Fixed assets 18,000 Equity Taxable income $21,500 Total 83.000 $145,000 Taxes (34%) 7310 $145,000 Total Net income $14,190

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts