Question: Question Completion Status: QUESTION 21 25 points Son A Consider a put option with a strike price of $60 and current price of $4. Also

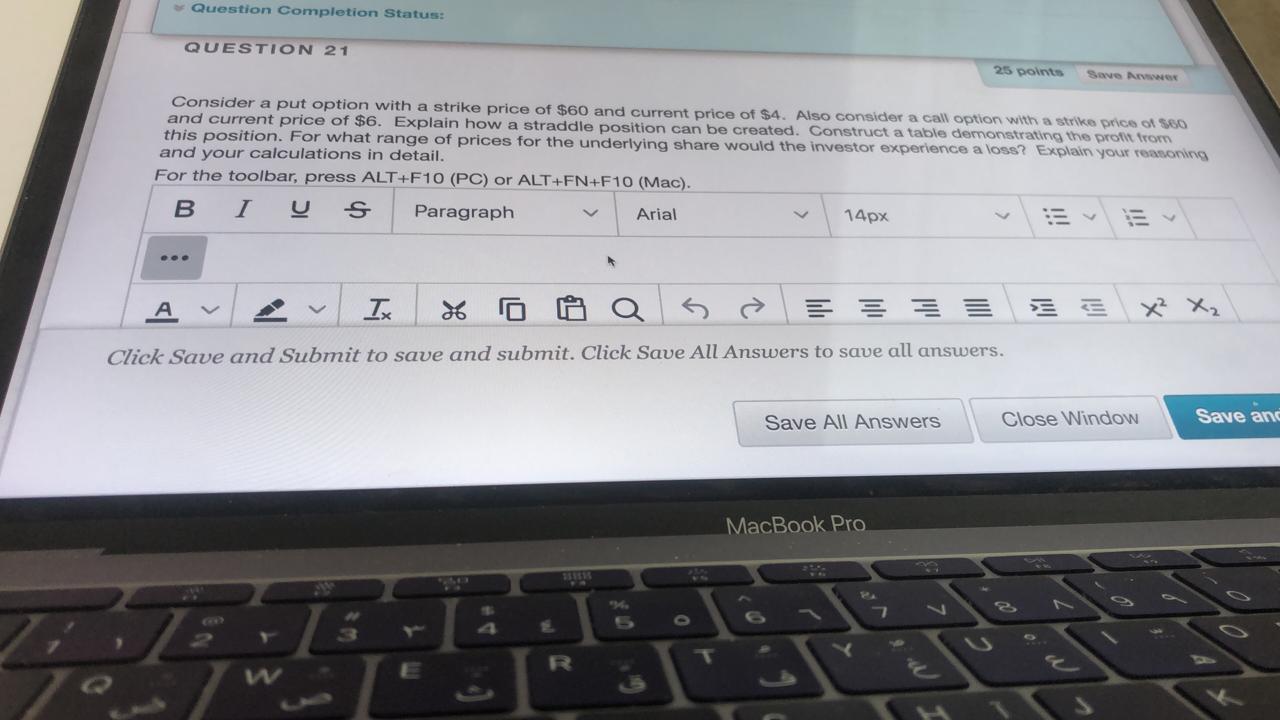

Question Completion Status: QUESTION 21 25 points Son A Consider a put option with a strike price of $60 and current price of $4. Also consider a call option with a strike price of 500 and current price of $6. Explain how a straddle position can be created. Construct a table demonstrating the profit from this position. For what range of prices for the underlying share would the investor experience a loss? Explain your reading and your calculations in detail. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B 1 Paragraph Arial 14px IX 46 X X Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Close Window Save an MacBook Pro Tann is lovel Question Completion Status: QUESTION 21 25 points Son A Consider a put option with a strike price of $60 and current price of $4. Also consider a call option with a strike price of 500 and current price of $6. Explain how a straddle position can be created. Construct a table demonstrating the profit from this position. For what range of prices for the underlying share would the investor experience a loss? Explain your reading and your calculations in detail. For the toolbar, press ALT+F10 (PC) or ALT+FN+F10 (Mac). B 1 Paragraph Arial 14px IX 46 X X Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Close Window Save an MacBook Pro Tann is lovel

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts