Question: Select the correct one: Question 1 (0.5 points) The presumption of abuse arises in Chapter 7, Chapter 11, and Chapter 13 cases. O True O

Select the correct one:

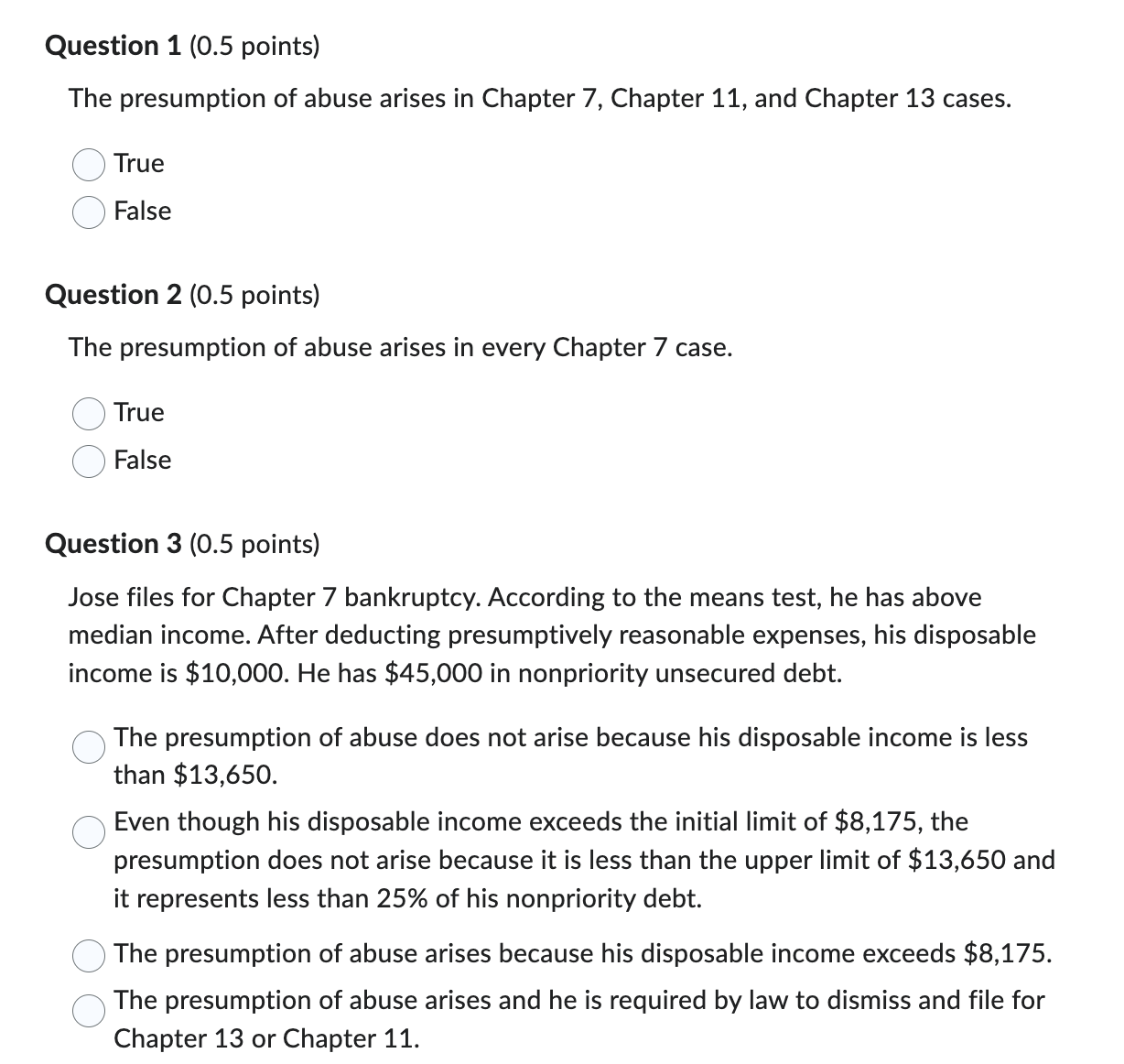

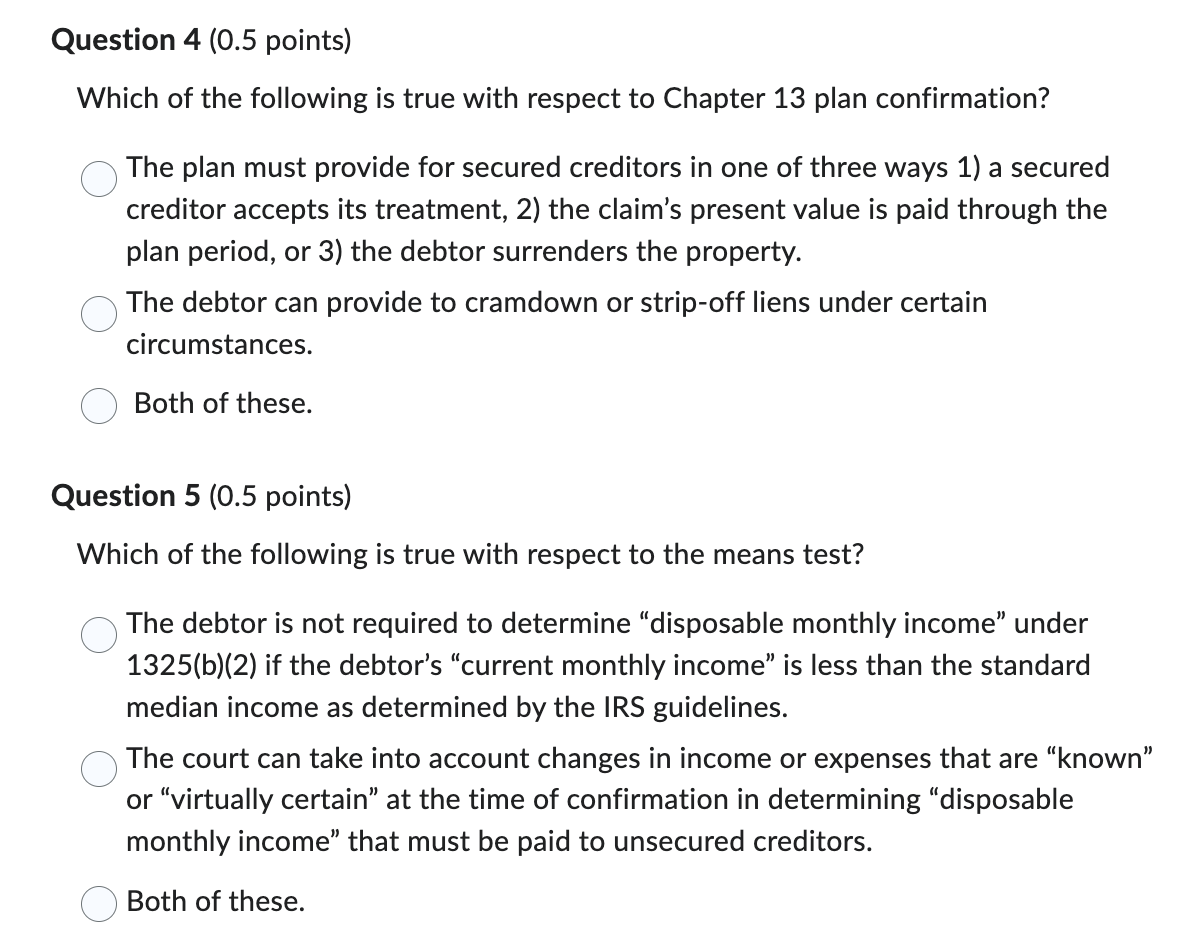

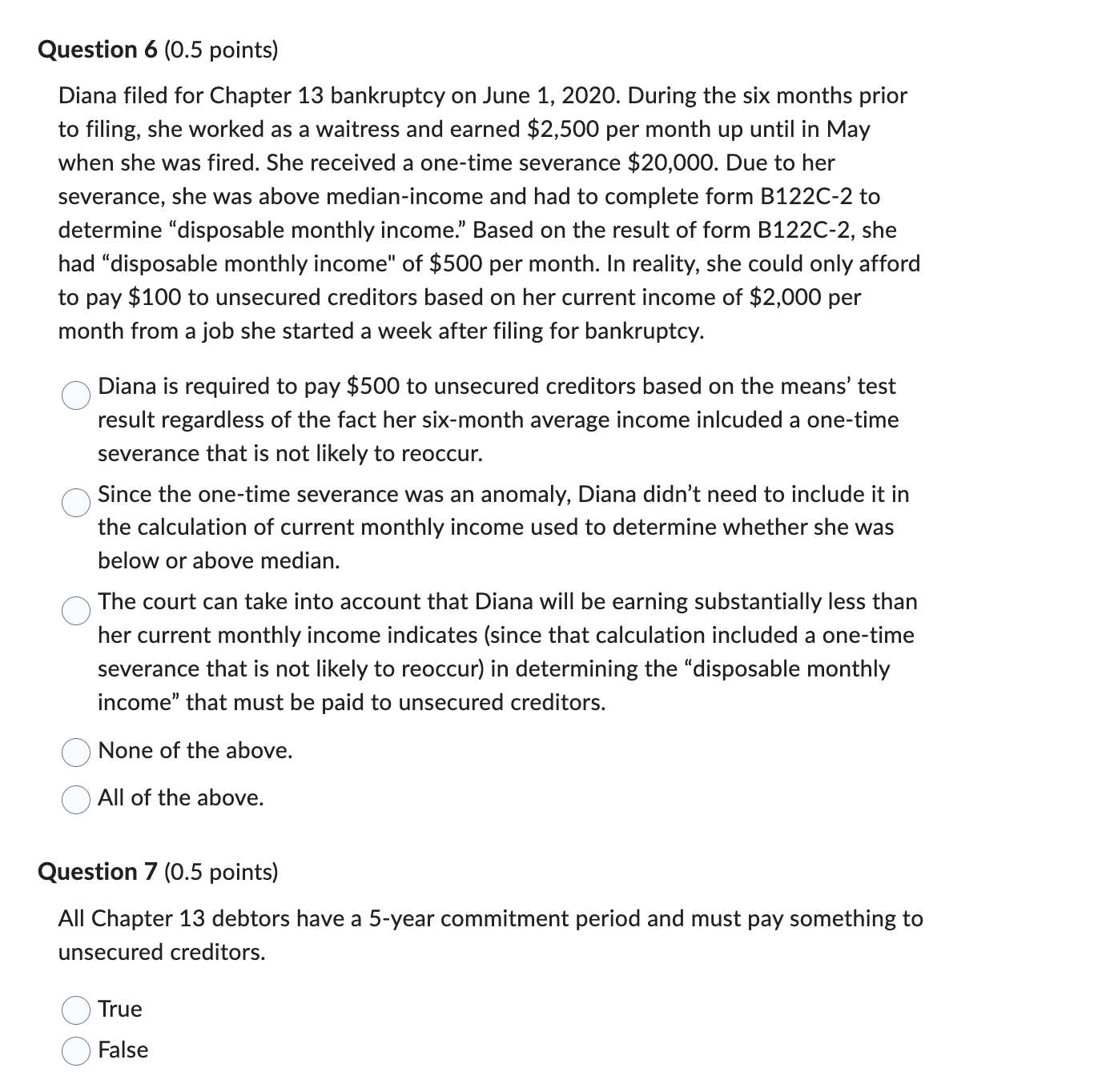

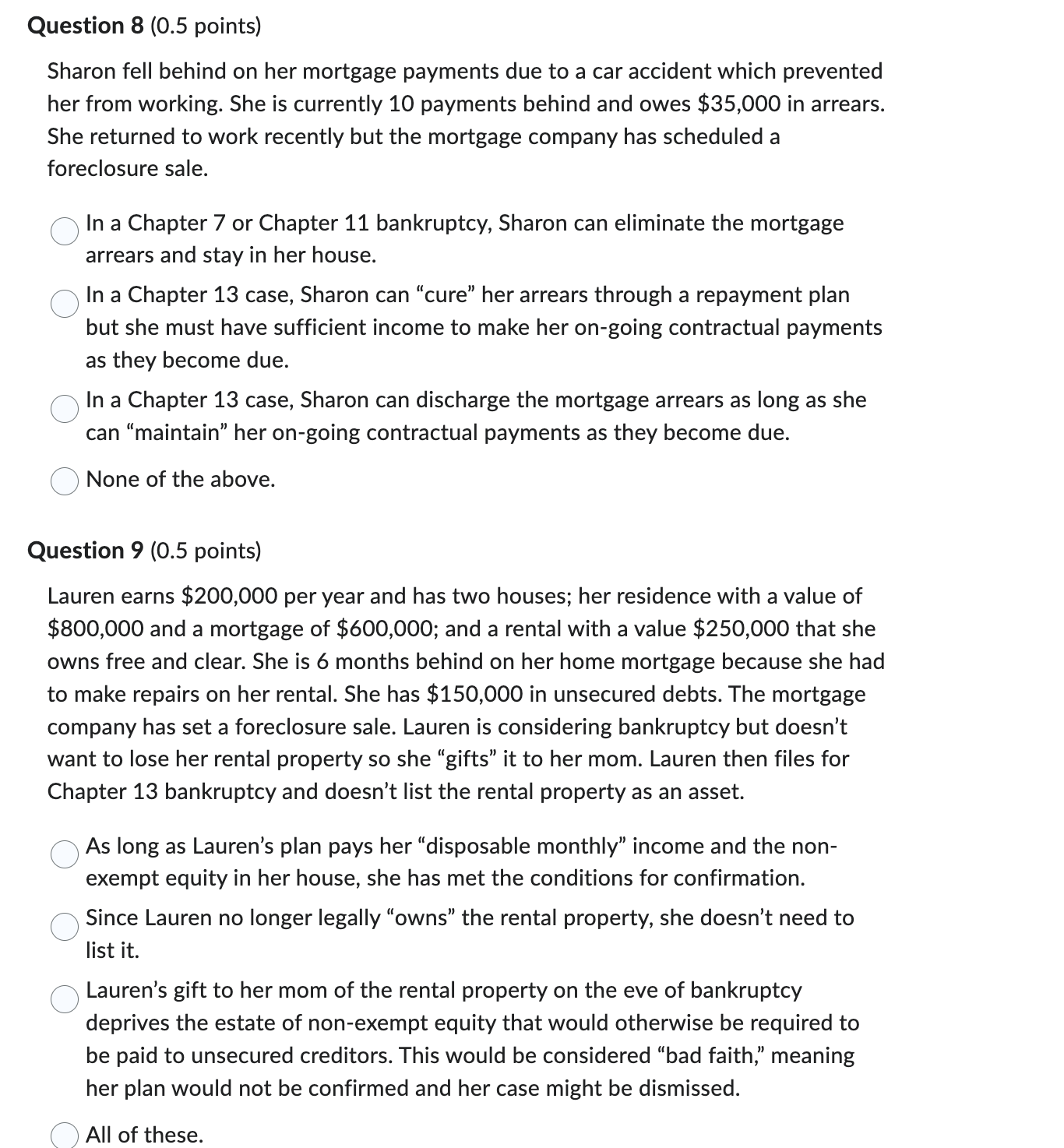

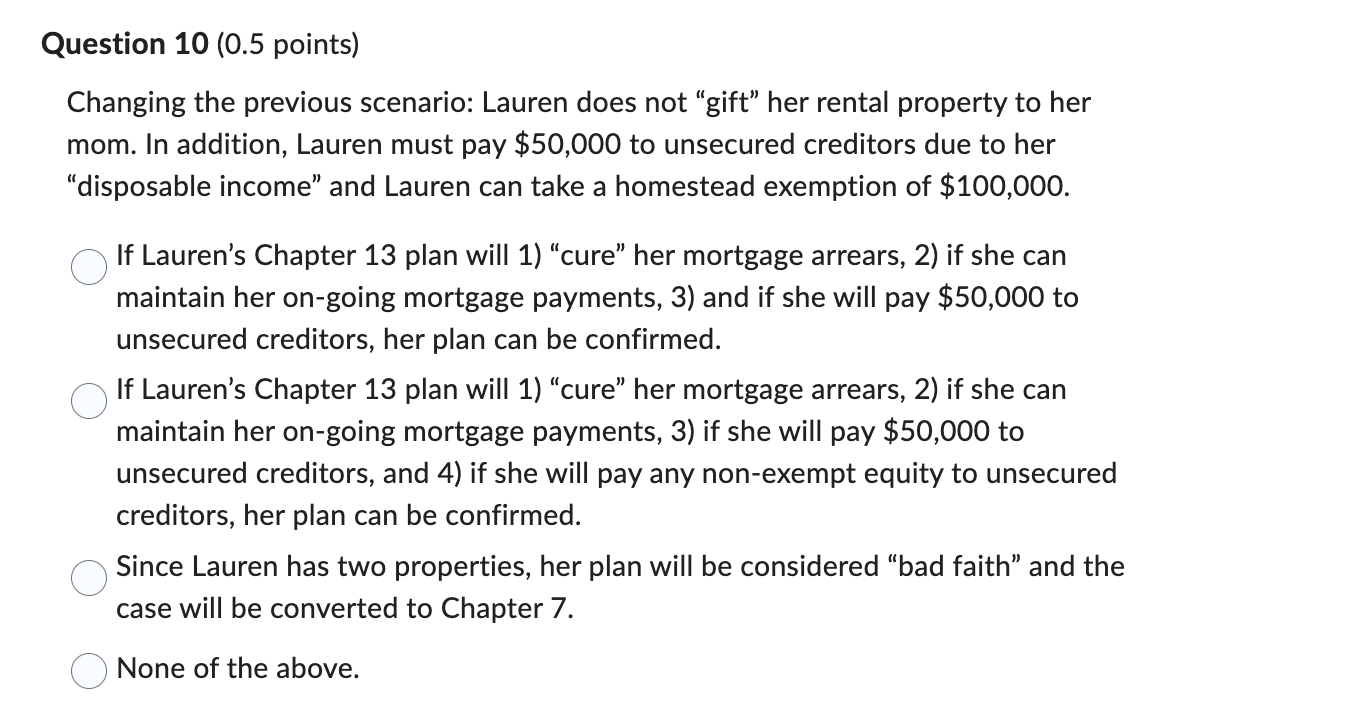

Question 1 (0.5 points) The presumption of abuse arises in Chapter 7, Chapter 11, and Chapter 13 cases. O True O False Question 2 (0.5 points) The presumption of abuse arises in every Chapter 7 case. True False Question 3 (0.5 points) Jose files for Chapter 7 bankruptcy. According to the means test, he has above median income. After deducting presumptively reasonable expenses, his disposable income is $10,000. He has $45,000 in nonpriority unsecured debt. C The presumption of abuse does not arise because his disposable income is less than $13,650. Even though his disposable income exceeds the initial limit of $8,175, the presumption does not arise because it is less than the upper limit of $13,650 and it represents less than 25% of his nonpriority debt. The presumption of abuse arises because his disposable income exceeds $8,175. C The presumption of abuse arises and he is required by law to dismiss and file for Chapter 13 or Chapter 11.Question 4 (0.5 points) Which of the following is true with respect to Chapter 13 plan confirmation? The plan must provide for secured creditors in one of three ways 1) a secured creditor accepts its treatment, 2) the claim's present value is paid through the plan period, or 3) the debtor surrenders the property. C The debtor can provide to cramdown or strip-off liens under certain circumstances. Both of these. Question 5 (0.5 points) Which of the following is true with respect to the means test? The debtor is not required to determine "disposable monthly income" under 1325(b)(2) if the debtor's "current monthly income" is less than the standard median income as determined by the IRS guidelines. The court can take into account changes in income or expenses that are "known" or "virtually certain" at the time of confirmation in determining "disposable monthly income" that must be paid to unsecured creditors. OBoth of these.Question 6 (0.5 points) Diana filed for Chapter 13 bankruptcy on June 1, 2020. During the six months prior to filing, she worked as a waitress and earned $2,500 per month up until in May when she was fired. She received a one-time severance $20,000. Due to her severance, she was above median-income and had to complete form B122C-2 to determine "disposable monthly income." Based on the result of form B122C-2, she had "disposable monthly income" of $500 per month. In reality, she could only afford to pay $100 to unsecured creditors based on her current income of $2,000 per month from a job she started a week after filing for bankruptcy. Diana is required to pay $500 to unsecured creditors based on the means' test result regardless of the fact her six-month average income inlcuded a one-time severance that is not likely to reoccur. Since the one-time severance was an anomaly, Diana didn't need to include it in the calculation of current monthly income used to determine whether she was below or above median. The court can take into account that Diana will be earning substantially less than her current monthly income indicates (since that calculation included a one-time severance that is not likely to reoccur) in determining the "disposable monthly income" that must be paid to unsecured creditors. None of the above. All of the above. Question 7 (0.5 points) All Chapter 13 debtors have a 5-year commitment period and must pay something to unsecured creditors. True FalseQuestion 8 (0.5 points) Sharon fell behind on her mortgage payments due to a car accident which prevented her from working. She is currently 10 payments behind and owes $35,000 in arrears. She returned to work recently but the mortgage company has scheduled a foreclosure sale. In a Chapter 7 or Chapter 11 bankruptcy, Sharon can eliminate the mortgage arrears and stay in her house. O In a Chapter 13 case, Sharon can "cure" her arrears through a repayment plan but she must have sufficient income to make her on-going contractual payments as they become due. O In a Chapter 13 case, Sharon can discharge the mortgage arrears as long as she can "maintain" her on-going contractual payments as they become due. None of the above. Question 9 (0.5 points) Lauren earns $200,000 per year and has two houses; her residence with a value of $800,000 and a mortgage of $600,000; and a rental with a value $250,000 that she owns free and clear. She is 6 months behind on her home mortgage because she had to make repairs on her rental. She has $150,000 in unsecured debts. The mortgage company has set a foreclosure sale. Lauren is considering bankruptcy but doesn't want to lose her rental property so she "gifts" it to her mom. Lauren then files for Chapter 13 bankruptcy and doesn't list the rental property as an asset. As long as Lauren's plan pays her "disposable monthly" income and the non- exempt equity in her house, she has met the conditions for confirmation. Since Lauren no longer legally "owns" the rental property, she doesn't need to list it. Lauren's gift to her mom of the rental property on the eve of bankruptcy deprives the estate of non-exempt equity that would otherwise be required to be paid to unsecured creditors. This would be considered "bad faith," meaning her plan would not be confirmed and her case might be dismissed. All of these.Question 10 (0.5 points) Changing the previous scenario: Lauren does not "gift" her rental property to her mom. In addition, Lauren must pay $50,000 to unsecured creditors due to her "disposable income" and Lauren can take a homestead exemption of $100,000. O If Lauren's Chapter 13 plan will 1) "cure" her mortgage arrears, 2) if she can maintain her on-going mortgage payments, 3) and if she will pay $50,000 to unsecured creditors, her plan can be confirmed. O If Lauren's Chapter 13 plan will 1) "cure" her mortgage arrears, 2) if she can maintain her on-going mortgage payments, 3) if she will pay $50,000 to unsecured creditors, and 4) if she will pay any non-exempt equity to unsecured creditors, her plan can be confirmed. Since Lauren has two properties, her plan will be considered "bad faith" and the case will be converted to Chapter 7. ONone of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts