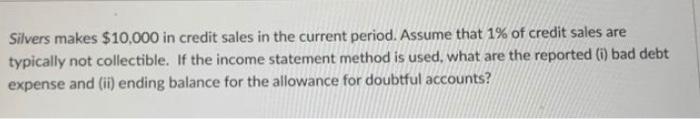

Question: Silvers makes $10,000 in credit sales in the current period. Assume that 1% of credit sales are typically not collectible. If the income statement

Silvers makes $10,000 in credit sales in the current period. Assume that 1% of credit sales are typically not collectible. If the income statement method is used, what are the reported (i) bad debt expense and (ii) ending balance for the allowance for doubtful accounts?

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Event General Journal Debit Credit Bad de... View full answer

Get step-by-step solutions from verified subject matter experts