Question: thats all information given, please show your work A. Plot historical prices for the six assets on the same line chart. B. Compute returns on

thats all information given, please show your work

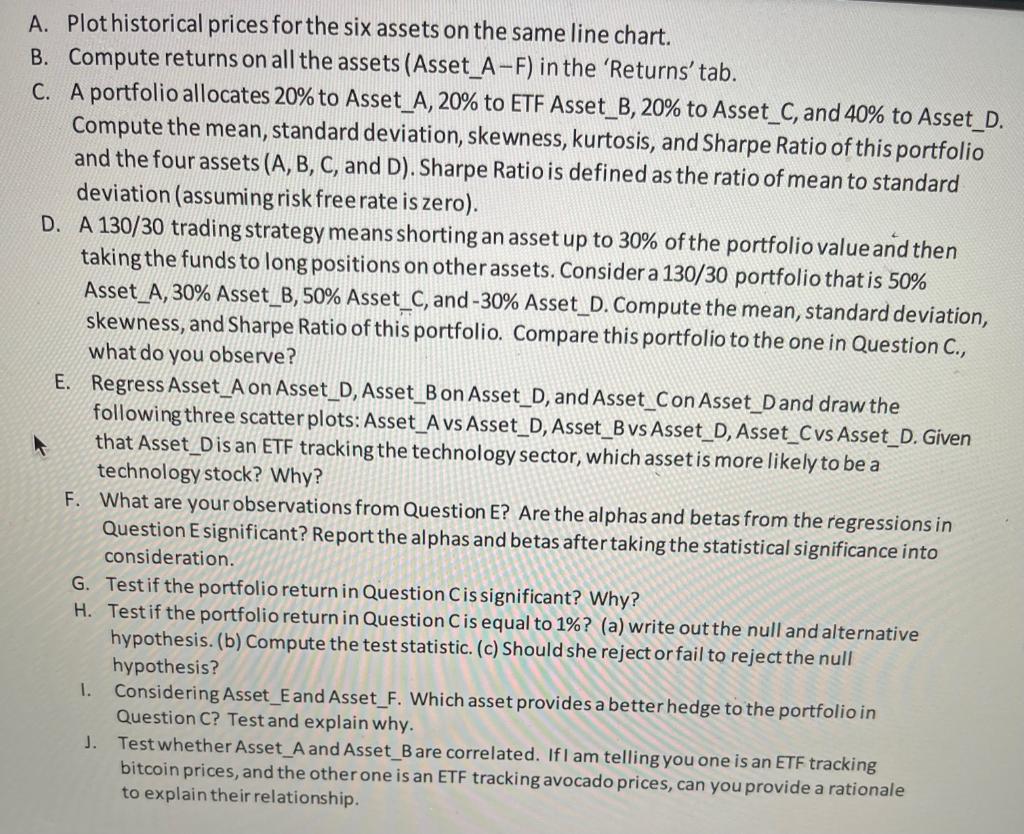

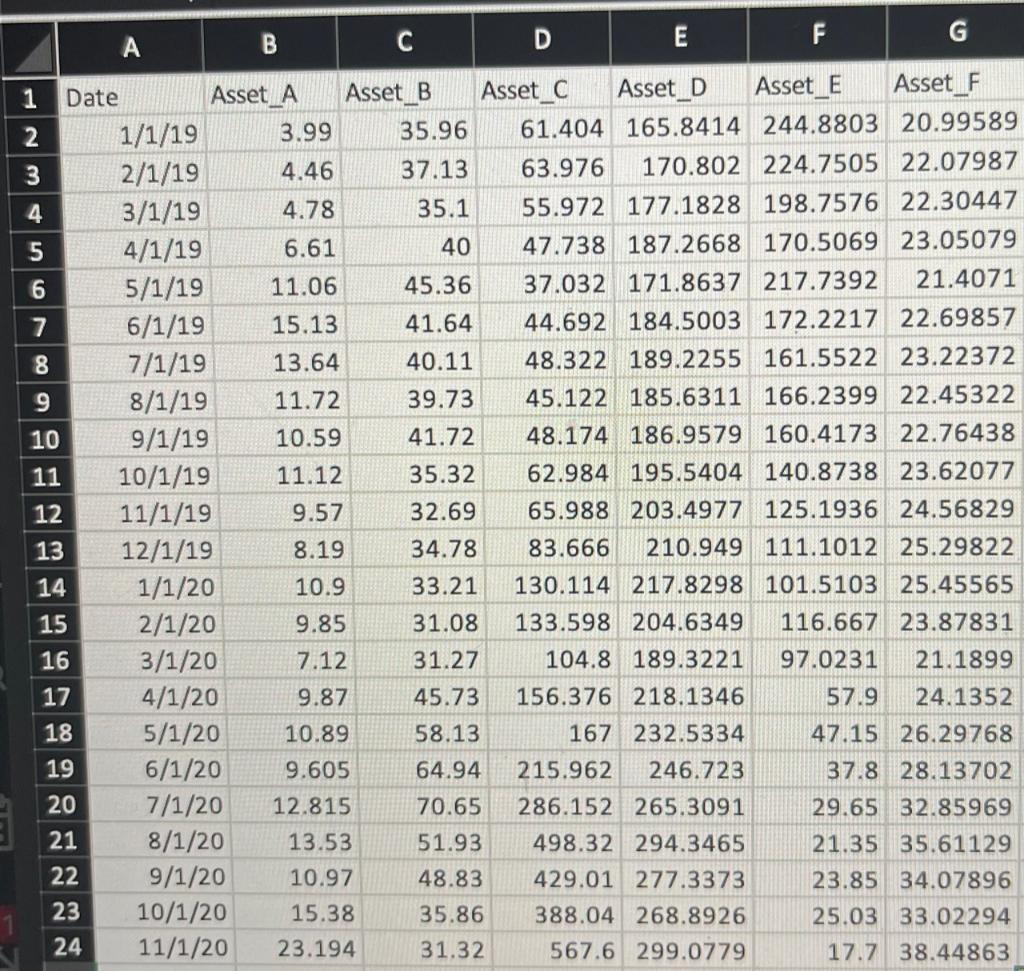

A. Plot historical prices for the six assets on the same line chart. B. Compute returns on all the assets (Asset_A-F) in the 'Returns' tab. C. A portfolio allocates 20% to Asset_A, 20% to ETF Asset_B, 20% to Asset_C, and 40% to Asset_D. Compute the mean, standard deviation, skewness, kurtosis, and Sharpe Ratio of this portfolio and the four assets (A, B, C, and D). Sharpe Ratio is defined as the ratio of mean to standard deviation (assuming risk free rate is zero). D. A 130/30 trading strategy means shorting an asset up to 30% of the portfolio value and then taking the funds to long positions on other assets. Consider a 130/30 portfolio that is 50% Asset_A, 30% Asset_B, 50% Asset_C, and -30% Asset_D. Compute the mean, standard deviation, skewness, and Sharpe Ratio of this portfolio. Compare this portfolio to the one in Question C., what do you observe? E. Regress Asset_A on Asset_D, Asset_Bon Asset_D, and Asset_Con Asset_Dand draw the following three scatter plots: Asset_A vs Asset_D, Asset_B vs Asset_D, Asset_C vs Asset_D. Given that Asset_Dis an ETF tracking the technology sector, which asset is more likely to be a technology stock? Why? F. What are your observations from Question E? Are the alphas and betas from the regressions in Question E significant? Report the alphas and betas after taking the statistical significance into consideration. G. Test if the portfolio return in Question Cis significant? Why? H. Test if the portfolio return in Question Cis equal to 1%? (a) write out the null and alternative hypothesis. (b) Compute the test statistic. (c) Should she reject or fail to reject the null hypothesis? Considering Asset_Eand Asset_F. Which asset provides a better hedge to the portfolio in Question C? Test and explain why. J. Test whether Asset_A and Asset_B are correlated. If I am telling you one is an ETF tracking bitcoin prices, and the other one is an ETF tracking avocado prices, can you provide a rationale to explain their relationship. 1. C D F B E G W NA 00 8 1 Date Asset_A Asset_B Asset F Asset_C Asset_D Asset_E 2 1/1/19 3.99 35.96 61.404 165.8414 244.8803 20.99589 3 2/1/19 4.46 37.13 63.976 170.802 224.7505 22.07987 4 3/1/19 4.78 35.1 55.972 177.1828 198.7576 22.30447 5 4/1/19 6.61 40 47.738 187.2668 170.5069 23.05079 6 5/1/19 11.06 45.36 37.032 171.8637 217.7392 21.4071 7 6/1/19 15.13 41.64 44.692 184.5003 172.2217 22.69857 7/1/19 13.64 40.11 48.322 189.2255 161.5522 23.22372 9 8/1/19 11.72 39.73 45.122 185.6311 166.2399 22.45322 10 9/1/19 10.59 41.72 48.174 186.9579 160.4173 22.76438 11 10/1/19 11.12 35.32 62.984 195.5404 140.8738 23.62077 12 11/1/19 9.57 32.69 65.988 203.4977 125.1936 24.56829 13 12/1/19 8.19 34.78 83.666 210.949 111.1012 25.29822 14 1/1/20 10.9 33.21 130.114 217.8298 101.5103 25.45565 15 2/1/20 9.85 31.08 133.598 204.6349 116.667 23.87831 16 3/1/20 7.12 31.27 104.8 189.3221 97.0231 21.1899 17 4/1/20 9.87 45.73 156.376 218.1346 57.9 24.1352 18 5/1/20 10.89 58.13 167 232.5334 47.15 26.29768 19 6/1/20 9.605 64.94 215.962 246.723 37.8 28.13702 20 7/1/20 12.815 70.65 286.152 265.3091 29.65 32.85969 21 8/1/20 13.53 51.93 498.32 294.3465 21.35 35.61129 22 9/1/20 10.97 48.83 429.01 277.3373 23.85 34.07896 23 10/1/20 15.38 35.86 388.04 268.8926 25.03 33.02294 24 11/1/20 23.194 31.32 567.6 299.0779 17.7 38.44863 A. Plot historical prices for the six assets on the same line chart. B. Compute returns on all the assets (Asset_A-F) in the 'Returns' tab. C. A portfolio allocates 20% to Asset_A, 20% to ETF Asset_B, 20% to Asset_C, and 40% to Asset_D. Compute the mean, standard deviation, skewness, kurtosis, and Sharpe Ratio of this portfolio and the four assets (A, B, C, and D). Sharpe Ratio is defined as the ratio of mean to standard deviation (assuming risk free rate is zero). D. A 130/30 trading strategy means shorting an asset up to 30% of the portfolio value and then taking the funds to long positions on other assets. Consider a 130/30 portfolio that is 50% Asset_A, 30% Asset_B, 50% Asset_C, and -30% Asset_D. Compute the mean, standard deviation, skewness, and Sharpe Ratio of this portfolio. Compare this portfolio to the one in Question C., what do you observe? E. Regress Asset_A on Asset_D, Asset_Bon Asset_D, and Asset_Con Asset_Dand draw the following three scatter plots: Asset_A vs Asset_D, Asset_B vs Asset_D, Asset_C vs Asset_D. Given that Asset_Dis an ETF tracking the technology sector, which asset is more likely to be a technology stock? Why? F. What are your observations from Question E? Are the alphas and betas from the regressions in Question E significant? Report the alphas and betas after taking the statistical significance into consideration. G. Test if the portfolio return in Question Cis significant? Why? H. Test if the portfolio return in Question Cis equal to 1%? (a) write out the null and alternative hypothesis. (b) Compute the test statistic. (c) Should she reject or fail to reject the null hypothesis? Considering Asset_Eand Asset_F. Which asset provides a better hedge to the portfolio in Question C? Test and explain why. J. Test whether Asset_A and Asset_B are correlated. If I am telling you one is an ETF tracking bitcoin prices, and the other one is an ETF tracking avocado prices, can you provide a rationale to explain their relationship. 1. C D F B E G W NA 00 8 1 Date Asset_A Asset_B Asset F Asset_C Asset_D Asset_E 2 1/1/19 3.99 35.96 61.404 165.8414 244.8803 20.99589 3 2/1/19 4.46 37.13 63.976 170.802 224.7505 22.07987 4 3/1/19 4.78 35.1 55.972 177.1828 198.7576 22.30447 5 4/1/19 6.61 40 47.738 187.2668 170.5069 23.05079 6 5/1/19 11.06 45.36 37.032 171.8637 217.7392 21.4071 7 6/1/19 15.13 41.64 44.692 184.5003 172.2217 22.69857 7/1/19 13.64 40.11 48.322 189.2255 161.5522 23.22372 9 8/1/19 11.72 39.73 45.122 185.6311 166.2399 22.45322 10 9/1/19 10.59 41.72 48.174 186.9579 160.4173 22.76438 11 10/1/19 11.12 35.32 62.984 195.5404 140.8738 23.62077 12 11/1/19 9.57 32.69 65.988 203.4977 125.1936 24.56829 13 12/1/19 8.19 34.78 83.666 210.949 111.1012 25.29822 14 1/1/20 10.9 33.21 130.114 217.8298 101.5103 25.45565 15 2/1/20 9.85 31.08 133.598 204.6349 116.667 23.87831 16 3/1/20 7.12 31.27 104.8 189.3221 97.0231 21.1899 17 4/1/20 9.87 45.73 156.376 218.1346 57.9 24.1352 18 5/1/20 10.89 58.13 167 232.5334 47.15 26.29768 19 6/1/20 9.605 64.94 215.962 246.723 37.8 28.13702 20 7/1/20 12.815 70.65 286.152 265.3091 29.65 32.85969 21 8/1/20 13.53 51.93 498.32 294.3465 21.35 35.61129 22 9/1/20 10.97 48.83 429.01 277.3373 23.85 34.07896 23 10/1/20 15.38 35.86 388.04 268.8926 25.03 33.02294 24 11/1/20 23.194 31.32 567.6 299.0779 17.7 38.44863

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts