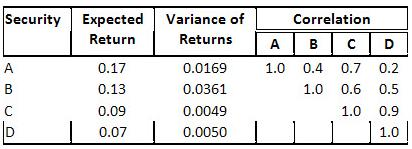

Question: The expected returns, return variances, and the correlation between the returns of four securities are as follows. Determine the expected return and variance for a

The expected returns, return variances, and the correlation between the returns of four securities are as follows.

- Determine the expected return and variance for a portfolio composed of 25% of security A and 75% of security B.

- Determine the expected return and variance of a portfolio that contains 78% security A and 22% security B. Is this portfolio superior to that one in (a) above?

- Calculate the expected return and variance of a portfolio that contains 60% security C and 40% security D.

- If a risk-averse investor desires to hold a portfolio of only two securities and expects a return of 11%, what would you advise the investor to do?

- Determine the expected return and variance of a portfolio that contains equal dollar amounts of the four securities.

- If an investor were to select among the following three portfolios, which one would he or she prefer?

An equally-weighted portfolio of securities A, B, and C.

An equally-weighted portfolio of A, B, and D.

An equally-weighted portfolio of B, C, and D.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts