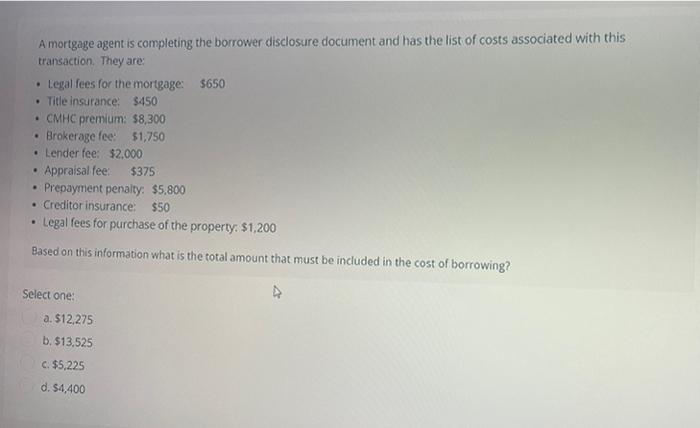

Question: This is a case study two part question A mortgage agent is completing the borrower disclosure document and has the list of costs associated with

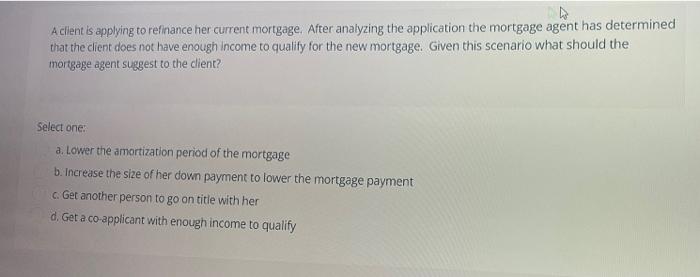

A mortgage agent is completing the borrower disclosure document and has the list of costs associated with this transaction. They are Legal fees for the mortgage: $650 Title insurance: $450 CMHC premium: $8,300 Brokerage fee: $1,750 Lender fee: $2,000 Appraisal fee: $375 Prepayment penalty: $5,800 Creditor insurance $50 Legal fees for purchase of the property: $1,200 . . . Based on this information what is the total amount that must be included in the cost of borrowing? Select one: a. $12,275 b. $13,525 c. $5,225 d. $4,400 Aclient is applying to refinance her current mortgage. After analyzing the application the mortgage agent has determined that the client does not have enough income to quality for the new mortgage. Given this scenario what should the mortgage agent suggest to the client? Select one: a. Lower the amortization period of the mortgage b. Increase the size of her down payment to lower the mortgage payment c. Get another person to go on title with her d. Get a co applicant with enough income to qualify

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts