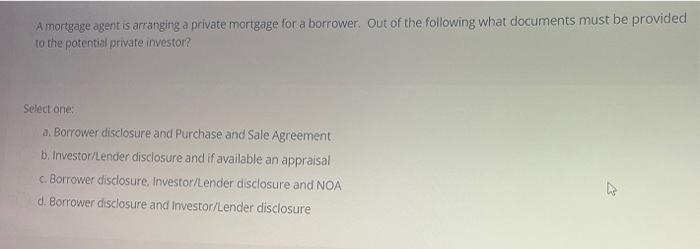

Question: This is part of a case study two part question A mortgage agent is arranging a private mortgage for a borrowerOut of the following what

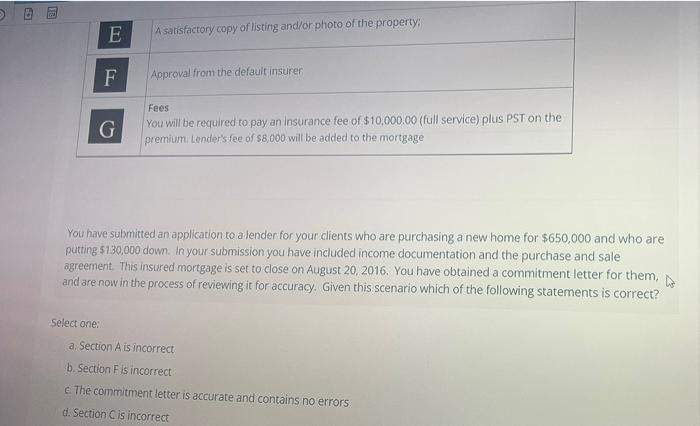

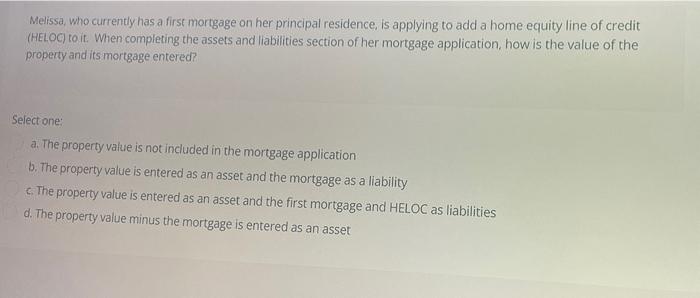

A mortgage agent is arranging a private mortgage for a borrowerOut of the following what documents must be provided to the potential private investor? Select one: a. Borrower disclosure and Purchase and Sale Agreement b. Investor/Lender disclosure and if available an appraisal c. Borrower disclosure Investor/Lender disclosure and NOA d. Borrower disclosure and Investor/Lender disclosure E satisfactory copy of listing and/or photo of the property: F. Approval from the default insurer G Fees You will be required to pay an insurance fee of $10,000.00 (full service) plus PST on the premium Lender's fee of $8,000 will be added to the mortgage You have submitted an application to a lender for your clients who are purchasing a new home for $650,000 and who are putting $130,000 down. In your submission you have included income documentation and the purchase and sale agreement. This insured mortgage is set to close on August 20, 2016. You have obtained a commitment letter for them, and are now in the process of reviewing it for accuracy. Given this scenario which of the following statements is correct? Select one: a Section A is incorrect b. Section Fis incorrect The commitment letter is accurate and contains no errors d. Section Cis incorrect Melissa, who currently has a first mortgage on her principal residence, is applying to add a home equity line of credit (HELOC) to it. When completing the assets and liabilities section of her mortgage application, how is the value of the property and its mortgage entered? Select one: a. The property value is not included in the mortgage application b. The property value is entered as an asset and the mortgage as a liability The property value is entered as an asset and the first mortgage and HELOC as liabilities d. The property value minus the mortgage is entered as an asset

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts