Question: This is a case study two part question Amortgage agent's client does not qualify for a mortgage through an institutional lender. Because of this the

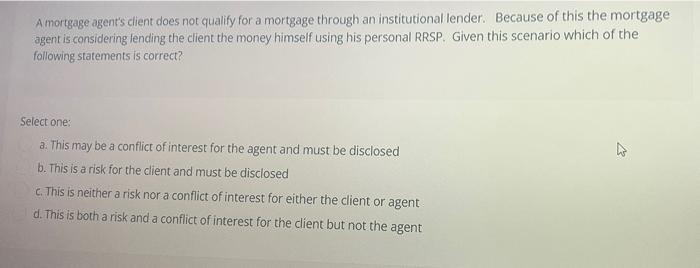

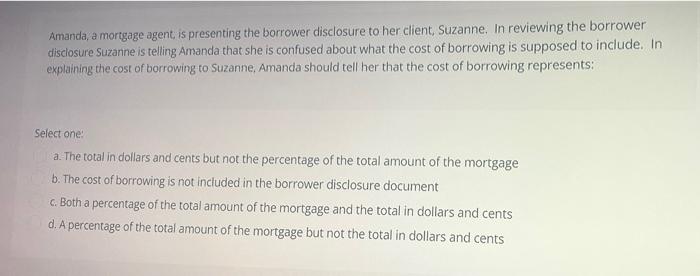

Amortgage agent's client does not qualify for a mortgage through an institutional lender. Because of this the mortgage agent is considering lending the client the money himself using his personal RRSP. Given this scenario which of the following statements is correct? Select one: a. This may be a conflict of interest for the agent and must be disclosed b. This is a risk for the client and must be disclosed c. This is neither a risk nor a conflict of interest for either the client or agent d. This is both a risk and a conflict of interest for the client but not the agent Amanda, a mortgage agent is presenting the borrower disclosure to her client, Suzanne. In reviewing the borrower disclosure Suzanne is telling Amanda that she is confused about what the cost of borrowing is supposed to include. In explaining the cost of borrowing to Suzanne, Amanda should tell her that the cost of borrowing represents: Select one: a. The total in dollars and cents but not the percentage of the total amount of the mortgage b. The cost of borrowing is not included in the borrower disclosure document c. Both a percentage of the total amount of the mortgage and the total in dollars and cents d. A percentage of the total amount of the mortgage but not the total in dollars and cents

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts