Question: This is for a case study two part question Your client is applying for a mortgage to purchase a ten year old home. After discussing

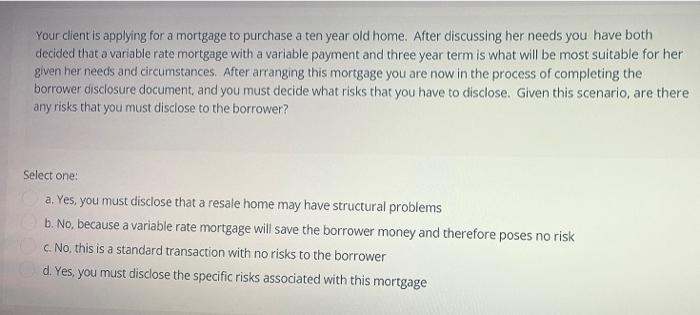

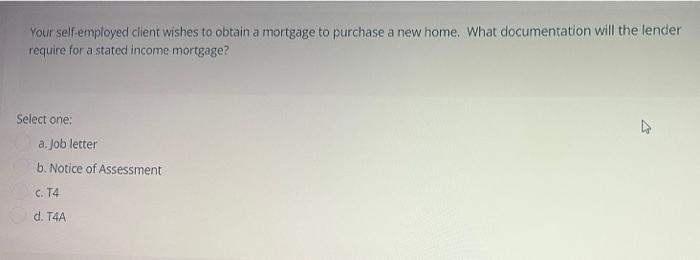

Your client is applying for a mortgage to purchase a ten year old home. After discussing her needs you have both decided that a variable rate mortgage with a variable payment and three year term is what will be most suitable for her given her needs and circumstances. After arranging this mortgage you are now in the process of completing the borrower disclosure document, and you must decide what risks that you have to disclose. Given this scenario, are there any risks that you must disclose to the borrower? Select one: a. Yes, you must disclose that a resale home may have structural problems b. No, because a variable rate mortgage will save the borrower money and therefore poses no risk c. No, this is a standard transaction with no risks to the borrower d. Yes, you must disclose the specific risks associated with this mortgage Your self-employed client wishes to obtain a mortgage to purchase a new home. What documentation will the lender require for a stated income mortgage? Select one: a. Job letter b. Notice of Assessment C. T4 d. T4A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts