Question: (This is a multi-step problem. If you make an error in the first step, it is unlikely that you will get the correct answers for

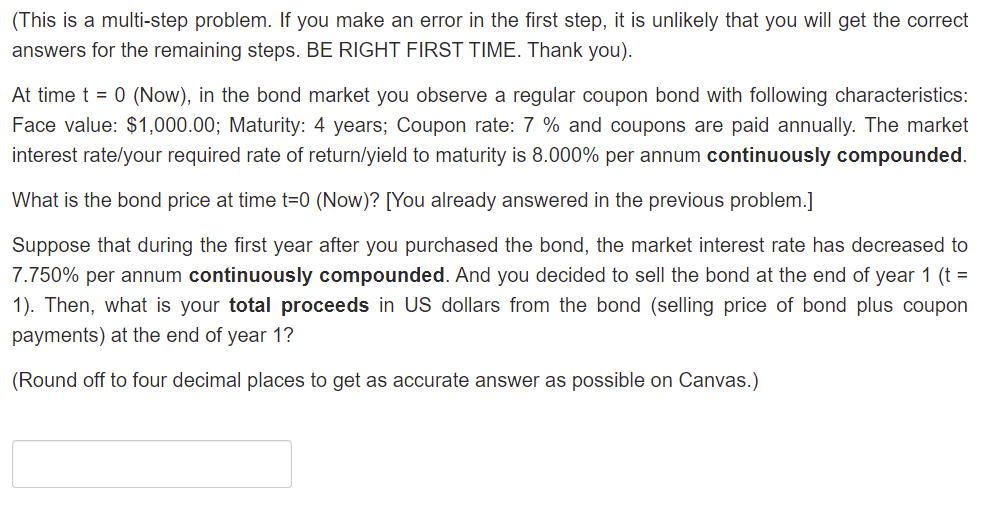

(This is a multi-step problem. If you make an error in the first step, it is unlikely that you will get the correct answers for the remaining steps. BE RIGHT FIRST TIME. Thank you). At time t = 0 (Now), in the bond market you observe a regular coupon bond with following characteristics: Face value: $1,000.00; Maturity: 4 years; Coupon rate: 7 % and coupons are paid annually. The market interest rate your required rate of return/yield to maturity is 8.000% per annum continuously compounded. What is the bond price at time t=0 (Now)? [You already answered in the previous problem.] Suppose that during the first year after you purchased the bond, the market interest rate has decreased to 7.750% per annum continuously compounded. And you decided to sell the bond at the end of year 1 (t = 1). Then, what is your total proceeds in US dollars from the bond (selling price of bond plus coupon payments) at the end of year 1? (Round off to four decimal places to get as accurate answer as possible on Canvas.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts