Question: This is an old test we took and I would just like some clarification on what the answers were and why. thanks! 6. If the

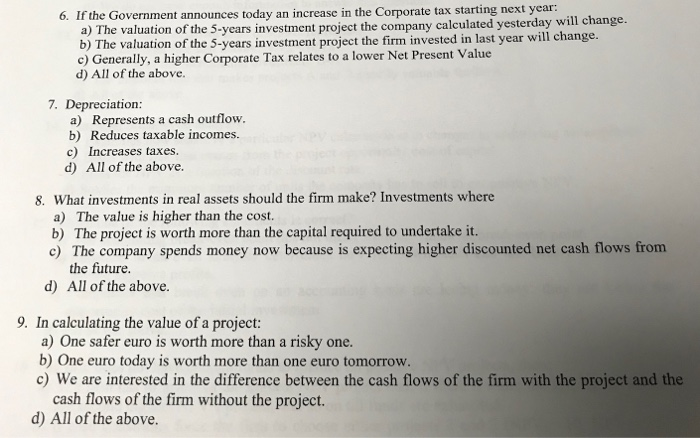

6. If the Government announces today an increase in the Corporate tax starting next year a) The valuation of the 5-years investment project the company calculated yesterday will change. b) The valuation of the 5-years investment project the firm invested in last year will change. c) Generally, a higher Corporate Tax relates to a lower Net Present Value d) All of the above. 7. Depreciation a) Represents a cash outflow. b) Reduces taxable incomes. c) Increases taxes. d) All of the above. 8. What investments in real assets should the firm make? Investments where a) The value is higher than the cost. b) The project is worth more than the capital required to undertake it. c) The company spends money now because is expecting higher discounted net cash flows from the future. d) All of the above. 9. In calculating the value of a project: a) One safer euro is worth more than a risky one. b) One euro today is worth more than one euro tomorrow. c) We are interested in the difference between the cash flows of the firm with the project and the cash flows of the firm without the project. d) All of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts