Question: This is an old test we took and I would just like some clarification on what the answers were and why. thanks! RINRUN Corporation, an

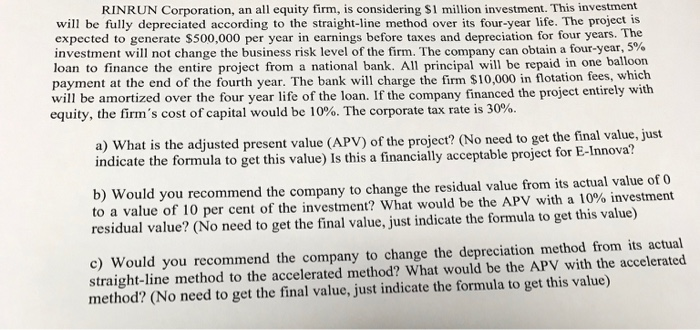

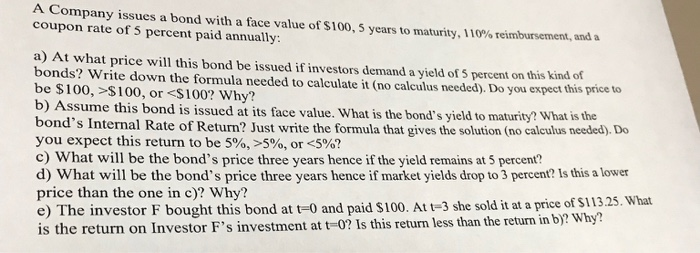

RINRUN Corporation, an all equity firm, is considering $1 million investment. This investment wil be fully depreciated according to the straight-line method over its four-year life. The project is expected to generate $500,000 per year in earnings before taxes and depreciation for four years. The investment will not change the business risk level of the firm. The company can obtain a four-year, 5 % loan to finance the entire project from a national bank. All principal will be repaid in one balloon payment at the end of the fourth year. The bank will charge the firm $10,000 in flotation fees, which will be amortized over the four year life of the loan. If the company financed the project entirely with equity, the firm's cost of capital would be 10 %. The corporate tax rate is 30% a) What is the adjusted present value (APV) of the project? (No need to get the final value, just indicate the formula to get this value) Is this a financially acceptable project for E-Innova? b) Would you recommend the company to change the residual value from its actual value of 0 to a value of 10 per cent of the investment? What would be the APV with a 10% investment residual value? (No need to get the final value, just indicate the formula to get this value) c) Would you recommend the company to change the depreciation method from its actual straight-line method to the accelerated method? What would be the APV with the accelerated method? (No need to get the final value, just indicate the formula to get this value) A Company issues a bond with a face value of $100, 5 years to coupon rate of 5 percent paid annually maturity, 110% reimbursement, and a a) At what price will this bond be issued if investors demand a yield of 5 percent on this kind of bonds? Write down the formula needed to calculate it (no calculus neede). Do you expect this price to be $100, >S100, or

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts